The American Express Payback Card is a practical option for those seeking to earn rewards without incurring high annual fees.

It lets you collect PAYBACK points on daily purchases, with redemption options available in Germany.

This guide explains how to apply, what you need, and how to maximize the value of using the card.

Eligibility Criteria

To apply for the American Express Payback Card, you need to meet a few basic requirements.

These ensure that your application is processed smoothly and increases your chances of approval.

- Age Requirement: You must be at least 18 years old.

- Residency: You must have a permanent residential address in Germany.

- Income: A stable monthly income is required (typically ₹3–5 lakhs annually).

- Credit History: A CIBIL score of 700 or above is generally preferred.

- PAN Card: A valid PAN card is mandatory for verification.

- Employment: Salaried or self-employed applicants must show proof of consistent income.

Documents Required

Before applying, make sure you have all the necessary documents ready. This helps avoid delays and speeds up the approval process.

- Proof of Identity: PAN card (mandatory)

- Proof of Address: Aadhar card, passport, or utility bill

- Proof of Income: Latest salary slip or 3-month bank statement

- Photograph: Recent passport-sized photo

- Mobile Number: An active German mobile number is required for verification.

- Email Address: Required for communication and online access setup

Application Process

Applying for the American Express Payback Card is quick and can be done entirely online.

Ensure your documents are ready and your details are accurate to avoid any delays during the verification process.

- Visit the Official Website: Go to the American Express Germany website.

- Select the Card: Choose the Payback Card from the list of available options.

- Fill out the Application Form: Enter your personal, employment, and financial details.

- Upload Documents: Submit scanned copies of your PAN card, address proof, and income proof.

- Submit the Application: Review your form and submit it for processing.

- Wait for Approval: You’ll receive updates by SMS or email. If approved, your card will arrive within 7–10 business days.

Card Features and Benefits

This card offers practical features designed to reward your everyday spending.

From earning points to added convenience and security, it brings value without extra cost.

- No Annual Fee: Enjoy the benefits without paying a yearly charge.

- PAYBACK Points on Every Purchase: Earn 1 PAYBACK point for every €2 spent

- Welcome Bonus: Receive a points bonus after your first transaction.

- Flexible Redemption: Use your points at PAYBACK partners or for rewards in the PAYBACK shop.

- Supplementary Cards: Add a free additional card for a family member.

- Online Account Management: Easily track transactions and points through your Amex account.

- Fraud Protection: Get complete coverage against unauthorized use after reporting your card as lost.

- Global Acceptance: Use the card at millions of locations worldwide where American Express is accepted.

Other Benefits

Beyond the basic rewards system, this card offers additional features that enhance its convenience and security for everyday use.

These extras offer more value, especially if you use your card regularly.

- Contactless Payments: Tap to pay quickly and securely without entering a PIN for small purchases.

- Free Monthly Statements: Receive detailed account summaries via email or post.

- Travel Accident Insurance: Coverage is included when travel is paid using the card.

- 24/7 Customer Support: Access assistance anytime through the American Express service hotline.

- Exclusive Amex Offers: Activate special discounts and cash back deals from select partner brands.

- Seamless PAYBACK Integration: View and manage your points directly from your PAYBACK account.

Interest Rates and Fees

Understanding the costs associated with this card helps you avoid unexpected expenses and manage your finances more effectively.

Here’s a detailed breakdown of what you might be charged:

- Annual Fee: €0 for the first year; €49 starting the second year, waived if you meet annual spending criteria (e.g., €10,000 per year).

- Interest Rate on Purchases: 16.99% p.a. for carried-over balances.

- Cash Advance Rate: 19.99% p.a. plus a fee of 3 % of the amount withdrawn (minimum €5).

- Late Payment Fee: €25 if the minimum payment is missed or made after the due date.

- Foreign Transaction Fee: 2 % on transactions made outside the Eurozone.

- Replacement Card Fee: €10 per card if a replacement is requested due to loss or damage.

These rates and fees are subject to change based on your creditworthiness and the latest American Express Germany terms.

Managing Your Account

Keeping track of your card activity is flexible and straightforward.

You can monitor spending, redeem points, and adjust settings through various tools offered by American Express.

- Online Account Access: Log in to your Amex account anytime to view transactions, download statements, or check your balance.

- Amex App: Use the mobile app to manage your card, track PAYBACK points, and receive real-time alerts.

- Automatic Payments: Set up a direct debit to ensure your monthly bills are paid on time without manual input.

- Spend Alerts: Activate notifications for purchases, payments, or when reaching a spending limit.

- PAYBACK Integration: Link your card to your PAYBACK account and manage your points in one place.

- Customer Service Support: For assistance with updating your details, replacing your card, or disputing a charge, please get in touch with our support team.

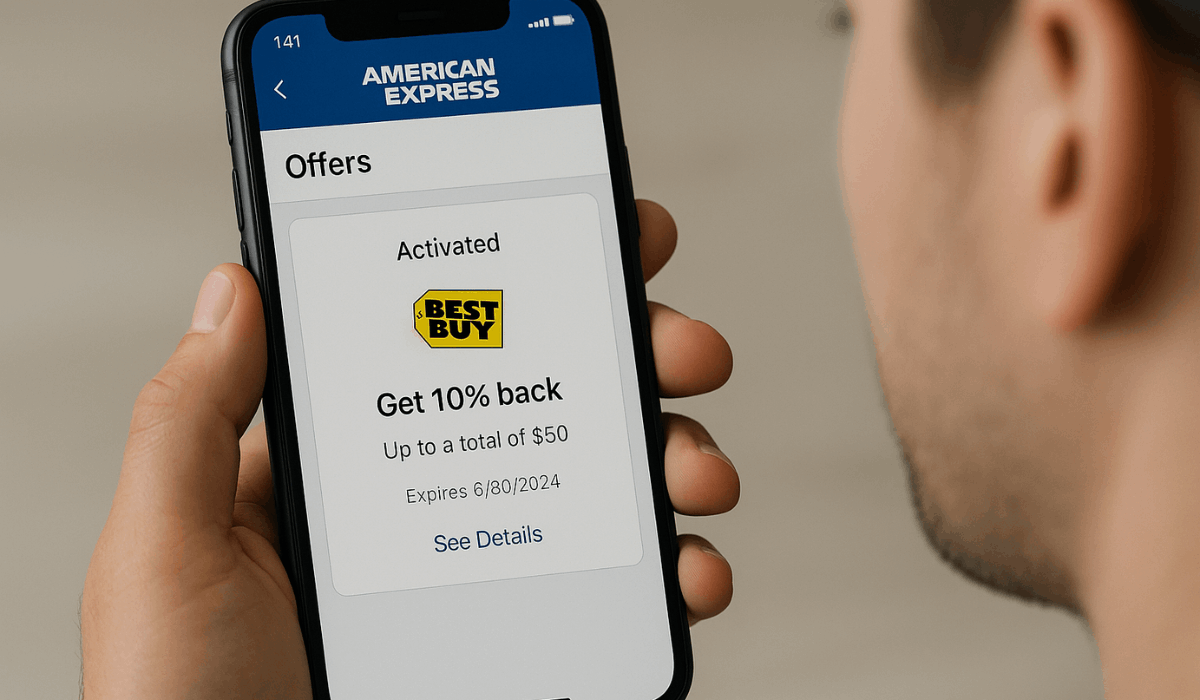

Hidden Perk: Amex Offers Page Access

A hidden benefit is access to the American Express Offers page, where you can find personalized discounts and cashback deals from top brands.

- Log in to Your American Express Account: Go to americanexpress.com/de and sign in with your credentials.

- Navigate to “Offers”: Find the “Amex Offers” section under your card overview.

- Activate Deals: Click “Add to Card” on the offers you want to use.

- Use Your Card at Participating Merchants: Make qualifying purchases to receive discounts or cashback automatically.

- Check Terms for Each Offer: Every promotion has specific conditions, such as minimum spend requirements or expiry dates.

- Get Notified of New Offers: Offers update regularly, so check back often or enable notifications in the app.

Physical vs. Virtual Card: What You Should Know

This card comes in physical and virtual forms, each with unique benefits. Using both smartly helps you get the most from your account.

- Virtual Card Access: Instantly available after approval for online use.

- Physical Card Delivery: Mailed and delivered within a few business days.

- Security Benefits: Helps protect your real card number during online shopping.

- Convenience: Works with Apple Pay or Google Pay before the physical card arrives.

- Same Rewards: Both versions earn PAYBACK points and offer equal perks.

- Proper Backup: Use the virtual card if the physical one is lost or delayed.

Customer Support Options

If you need help with your card in Germany, these are the official and reliable channels:

- 24/7 Phone Support: Call +49 (0)69 9797 1000 for general inquiries or card-related issues. This number is available 24/7.

- Corporate Card Lost/Stolen: Use the same number (+49 69 9797 1000) — support is available 24/7.

- Insurance Queries: Call +49 69 9797 2424, available Monday to Friday, 08:00–18:00.

- Global Travel Assistance: In an emergency abroad, dial +49 69 9797 1000 and select the “Insurance” option.

- Live Chat: Log in to the Amex Germany site to access secure live chat. Corporate merchants can also use chat via the merchant support page.

Conclusion: Apply Smart, Use Smarter

The American Express Payback Card provides a straightforward way to earn rewards on everyday spending with no high annual fees.

With easy online management, practical benefits, and PAYBACK integration, it’s a smart choice for regular card users in Germany.

Apply now through the official American Express Germany website to start earning points with every purchase.

Disclaimer

The information provided in this article is for general guidance only and may be subject to change by American Express Germany.

Always review the official terms and conditions on their website before applying.