The American Express Gold Card converts everyday spending into high-value Membership Rewards® points while layering dining, travel, and lifestyle credits that offset its annual fee.

Use this roadmap to determine if the card aligns with your habits, increase your approval odds, and complete the digital application without errors.

Amex Gold Card at a Glance

Gain rapid points on restaurants worldwide, earn statement credits that top the yearly fee, and avoid foreign transaction surcharges when traveling in the United Kingdom.

The result is a premium card that feels tailored to frequent diners, grocery shoppers, and regular flyers.

Who Benefits Most

Frequent restaurant visitors, households with sizable grocery bills, and travelers booking flights several times a year receive the richest return.

Applicants must be at least eighteen, hold U.S. citizenship or permanent residency, and show good to excellent credit, usually 700 FICO or higher. Occasional spenders who rarely tap bonus categories will struggle to justify the fee.

Core Costs and Welcome Offer

A quick review of the financial basics clarifies value before you hit Apply.

- Annual fee: $325, charged on the first statement and every twelve months thereafter.

- Welcome bonus: Earn 90,000 Membership Rewards® points after $6,000 in purchases during the first six months.

- APR range: 20.24 %–29.24 % variable on Pay Over Time balances.

- Foreign transaction fees: None, supporting smooth worldwide spending.

Responsible cardholders usually erase the fee through points redemptions and monthly statement credits during the first year.

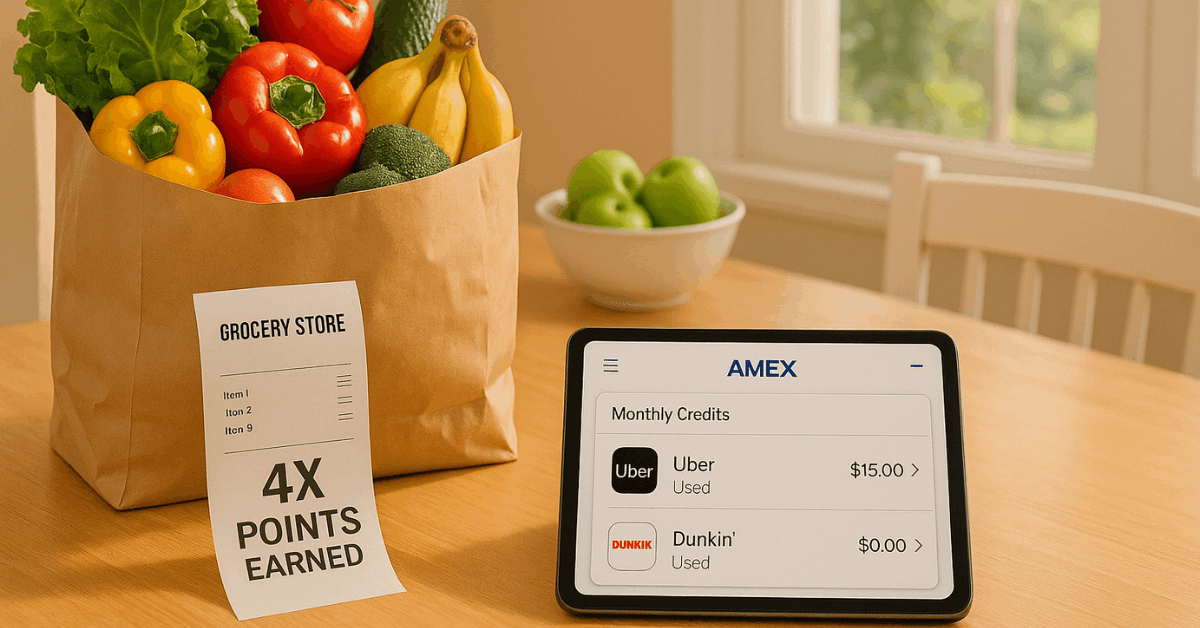

Reward Multipliers That Drive Everyday Value

Efficient point earning comes from using the card, which pays above-average rates rather than sporadically swiping everywhere.

| Spending Category | Points Rate | Annual Cap |

| Restaurants worldwide | 4 X | Up to $50,000 in purchases |

| U.S. supermarkets | 4 X | Up to $25,000 in purchases |

| Flights booked direct or on AmexTravel.com | 3 X | No stated cap |

| Prepaid hotels on AmexTravel.com | 2 X | No stated cap |

| All other eligible purchases | 1 X | Unlimited |

Use points for flights, hotel stays, gift cards, or transfers to airline partners to capture maximum redemption value—often 1.5 cents or more per point.

Statement Credits That Offset the Fee

Monthly and semi-annual credits transform ordinary activities into nearly automatic savings.

- Uber Cash – $120 yearly

Add the card to your Uber account and receive $10 every month for U.S. rides or Uber Eats orders. - Dining Credit – $120 yearly

Earn up to $10 each month at select partners after enrollment. - Resy Statement Credit – $100 yearly

Receive $50 twice per year on qualifying Resy restaurant charges. - Dunkin’ Credit – $84 yearly

Collect $7 monthly on purchases at U.S. Dunkin’ locations.

Combined, the credits exceed $500 annually, covering the fee for most users who activate and redeem them.

Design Choices and Flexible Payment Tools

Visual customization and payment planning features make account management feel personal and controlled.

- Color options: Choose Gold or Rose Gold during application; both versions carry identical perks.

- Pay Over Time: Convert eligible charges into a revolving balance that accrues interest within the posted APR range.

- Plan It®: Split purchases of $100+ into equal installments with a fixed fee instead of interest, visible in advance.

These tools support budget management without sacrificing point accumulation.

Eligibility Checklist

American Express evaluates several data points, not just score alone. Confirm alignment before starting the form.

- Credit score: Target at least 700 for comfortable approval chances.

- Income: Supply verifiable figures that justify the requested credit line relative to existing debts.

- Residency: Provide a valid U.S. address and Social Security number or ITIN.

- Application cadence: Amex usually limits consumers to one new credit card every five days and two within ninety days.

- Total Amex cards held: No more than four revolving cards and ten charge cards per person worldwide.

Meeting each criterion minimizes surprises during the automated review.

Strengthen Your Profile in Advance

Several quick adjustments can raise approval odds and unlock higher starting limits.

- Reduce balances on current cards to drive utilization below thirty percent.

- Request credit-line increases on older accounts; many issuers run soft pulls that do not harm scores.

- Scan your credit reports for errors through AnnualCreditReport.com and dispute any inaccurate negatives.

- Space out applications with other lenders to prevent a cluster of recent inquiries.

Lenders reward consistent, low-risk behavior, and these actions demonstrate precisely that.

Key Terms Every Applicant Should Master

Clear definitions prevent bill shock later and signal financial fluency to underwriters.

- Grace period: The time between the statement’s close and the due date when interest is waived on balances paid in full.

- Cash advance: ATM withdrawal is subject to immediate interest at a higher APR plus service fees.

- Minimum payment: The least amount due to maintaining good standing; paying only this figure incurs interest on the remainder.

- Foreign transaction fee: A surcharge that the Gold Card eliminates, preserving value worldwide.

Knowing the vocabulary empowers you to use credit strategically rather than reactively.

Step-by-Step Online Application

Gather personal and financial details first, then follow these five precise actions.

- Visit the official American Express Gold Card page through the worldwide portal.

- Select “Apply Now” to launch the secure application window.

- Input personal information—legal name, address, contact details, date of birth, Social Security number, and annual income.

- Choose Gold or Rose Gold finish, confirming that color has no effect on benefits.

- Review terms carefully and hit Submit to trigger an instant decision or a brief pending message.

Many applicants receive approval within seconds and can load a digital card to mobile wallets immediately. Physical cards usually arrive within ten business days.

Best Practices for a Smooth Submission

Follow these tips to avoid delays or unintentional rejections.

- Verify that reported income matches recent pay stubs or tax returns if requested.

- Use your full legal name consistently across credit files and the application.

- Apply from a secure, private internet connection and clear your browser cache beforehand to prevent session errors.

- Avoid duplicate submissions; multiple same-day attempts may flag fraud filters and lower scores through extra inquiries.

Questions during the process can be directed to 1-800-528-2122, where agents are available 24/7 to assist card members worldwide.

Responsible Use After Approval

Turning credit into long-term advantage depends on disciplined habits.

- Pay the statement balance in full every cycle to sidestep interest.

- Keep utilization comfortably under thirty percent of the assigned limit.

- Enroll in Uber, Dining, Resy, and Dunkin credits immediately to avoid any unused credits from lapsing.

- Review Amex Offers weekly; activating merchant deals can deliver extra statement credits or bonus points without requiring additional spending.

- Enable account alerts for transaction verification and payment reminders.

Solid behavior builds account age, which further boosts scores and positions you for higher limits or premium upgrades.

Frequently Asked Questions

More information through questions:

- Does a 750 score guarantee approval?

A single number never guarantees success, yet scores above 740 coupled with stable income present strong cases. - Will the Apply With Confidence pre-check hurt my credit?

No; the pre-approval tool performs a soft inquiry that does not affect scores unless you proceed to a full application. - Can authorized-user history alone secure future approval?

Positive authorized-user data helps, but American Express still requires personal income verification and an independent credit profile. - How many Amex cards can someone hold worldwide?

Current policy caps revolving consumer cards at four and charge cards at ten across all regions.

Unique American Express Rules Worth Noting

Planning around internal policies conserves welcome offers and avoids wasted pulls.

- Each specific card’s bonus is limited to once per lifetime per person.

- Amex may combine same-day inquiries yet still decline one application if overall limits exceed policy.

- Opening more than two consumer cards within ninety days usually triggers automatic denials regardless of credit strength.

Study these guardrails before selecting additional American Express products.

Conclusion

Applying for the American Express Gold Card becomes straightforward once you align spending patterns, credit standing, and application timing with issuer expectations.

Activate essential credits, focus purchases on restaurant, grocery, and flight categories, and treat the balance like cash payable in full.

Follow the structured steps above, and you position yourself for swift approval, high ongoing value, and a lasting relationship with a payment network respected worldwide.