Applying for a Barclaycard Visa is simple when you know what to expect.

With just a few key details and a quick online form, you can complete the process in minutes.

This guide clearly outlines each step, along with helpful tips that most people overlook.

Eligibility Requirements

Barclaycard will only approve applicants who fit specific criteria. Understanding these upfront saves you time and increases your chances of approval.

- You must be at least 18 years old.

Barclaycard only accepts applications from individuals who are legal adults and reside in the UK.

- You need to be a UK resident.

Permanent UK residency is required, including a valid UK address history for the past 3 years.

- You should have a regular income.

While there’s no fixed minimum, consistent earnings help prove you can repay what you borrow.

- You must have a fair to good credit history.

Late payments, defaults, or too many recent credit applications may lower your chances.

- You need to have a working UK mobile number and email address.

Barclaycard uses these to verify your identity and send updates during the process.

- You should not currently be declared bankrupt or in an IVA.

Financial stability is crucial for being approved for any credit card.

Documents and Info You’ll Need

Gathering the correct information in advance helps you complete the Barclaycard Visa application quickly and accurately.

- Full name and date of birth: Ensure your details match those on your official identification exactly.

- UK address history (last 3 years): This is required to check your credit history and confirm residency.

- Annual income before tax: Include all sources, such as salary, pensions, or freelance work.

- Employment status and employer details: If employed, provide your job title, company name, and how long you’ve worked there.

- Bank account number and sort code: Used for setting up repayments or direct debits after approval.

- Email address and mobile phone number: These are needed for communication and security verification during the process.

Step-by-Step Application Process

Ensure your details are accurate to expedite the approval process and prevent delays.

- Visit the Barclaycard Germany website: Open the Barclaycard site for Germany and select the Visa card that best suits your financial needs.

- Click “Jetzt beantragen” (Apply now): This will open the secure online application form.

- Enter your personal and financial information: Fill in your name, income, employment status, German address history, and contact info.

- Confirm and review your details: Verify that all information is accurate before submitting the form.

- Complete identity verification (PostIdent or VideoIdent): You’ll be asked to verify your identity through a Deutsche Post office or via video call.

- Wait for approval and card delivery: Once approved, your Barclaycard Visa will be mailed to your German address within a few business days.

Post-Approval Setup

These actions help activate your card, secure your account, and manage your spending from the very start.

- Activate your card: Use the instructions provided in the welcome letter or activate through the online banking platform.

- Set up your PIN: You’ll receive a PIN by mail or be prompted to create one during activation.

- Register for online banking: This provides you with full access to transactions, billing, and card controls at any time.

- Download the mobile app: Manage your card, view statements, and set limits right from your phone.

- Set up a direct debit for repayments: Choose to pay the minimum, full balance, or a custom amount each month automatically.

- Enable push notifications: Get real-time alerts for purchases, due dates, and unusual activity.

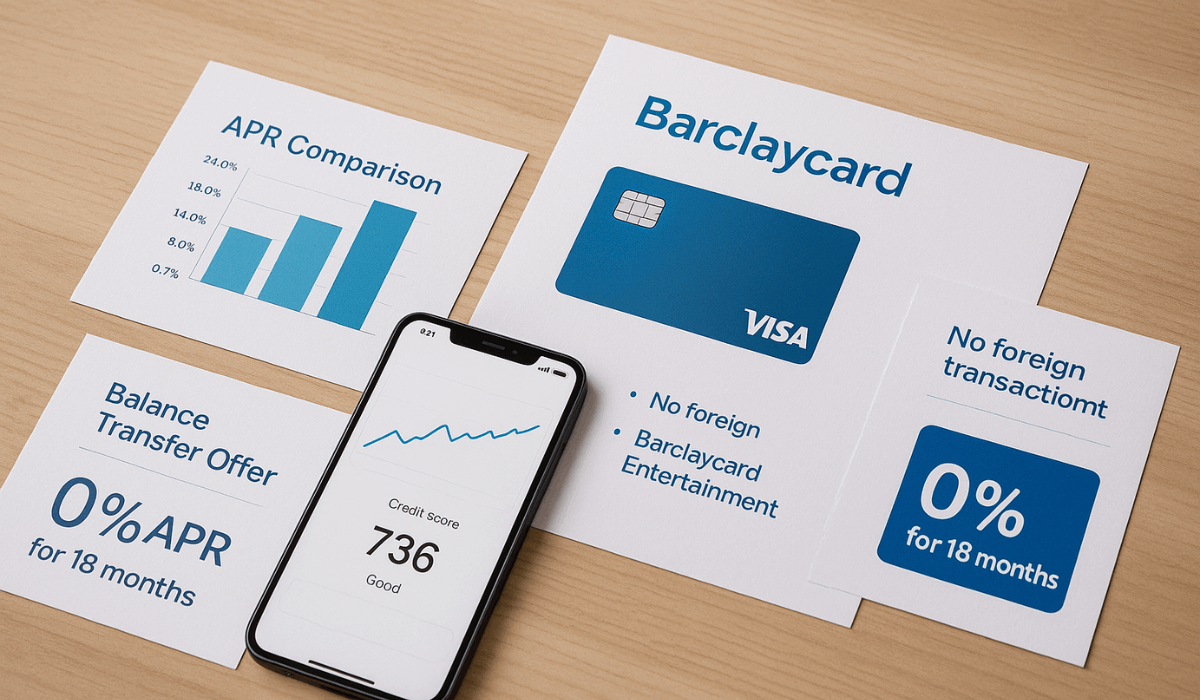

Rates and Fees Breakdown

Here’s a detailed look at the common interest rates and fees that apply to most Barclaycard Visa cards in Germany.

- Purchase interest rate: approx. 18.38% APR: Interest is charged if you don’t pay your full balance by the due date.

- Cash withdrawal fee: 3.5% (minimum €4.99). This fee applies when withdrawing money from ATMs or bank branches.

- Foreign currency transaction fee: 0%: No extra charges when using the card abroad or for non-euro payments.

- Late payment fee: €4 per missed payment: Charged if you don’t make the minimum payment on time.

- Balance transfer fee: up to 3.5%: Applies when transferring balances from other cards to this one.

- Monthly statement payment flexibility: Choose to pay in full or in fixed monthly installments (minimum 2% of the balance or €15).

Perks and Benefits You Might Not Notice

Beyond standard features, there are extra benefits that many users overlook.

These hidden perks can make your card more useful and save you money in the long run.

- Flexible payment options: You can split purchases into installments or set up monthly payments with adjustable rates.

- Free cash withdrawals in the Eurozone: Withdraw cash at no extra cost when using ATMs within Eurozone countries.

- Emergency card replacement service: Lost or stolen cards can be replaced quickly, even while abroad.

- Real-time purchase notifications: Stay in control of your spending with instant alerts on your mobile.

- Free access to your credit score: Track your credit performance through your online account.

- Exclusive partner discounts: Enjoy rotating offers on travel, entertainment, and shopping through our partner deals.

Tips That Improve Approval Odds

Taking a few smart steps can significantly boost your chances of getting approved.

These tips help present you as a reliable applicant during the review process.

- Check your Schufa score beforehand: Make sure your credit history in Germany is in good standing before applying.

- Use consistent personal data: Ensure that your name, address, and employment details are accurate and match across all relevant documents.

- Avoid applying for multiple cards at once: Too many recent credit inquiries can lower your chances of approval.

- List all sources of income: Include freelance, rental, or pension income if it’s steady and provable.

- Apply during business hours: Some systems flag late-night applications as unusual activity.

- Have your identification documents ready: Completing PostIdent or VideoIdent smoothly helps speed up the approval process.

Customer Support and Contact Info

If you need help, here are the most effective ways to reach Barclaycard in Germany.

You can choose the contact method that best suits your situation and receive fast support.

- General hotline: +49 40 890 99 0 (Mon–Fri, 08:00–20:00)

- Credit card support (existing customers): +49 40 890 99 866 (Mon–Fri, 08:00–20:00)

- New card inquiries: +49 40 890 99 899 (Mon–Fri, 08:00–20:00)

24/7 emergency lines:

- Report lost or stolen card: +49 40 890 99 877

- Report suspected fraud: +49 40 890 99 900

E‑mail support:

- General service: [email protected]

- Credit-related questions: [email protected]

- Complaints and feedback: [email protected]

Live chat:

- Available via the online banking portal or mobile app for logged‑in users (Mon–Fri 08:00–20:00)

Postal address:

- Barclays Bank Ireland plc, Hamburg Branch, Gasstraße 4c, 22761 Hamburg

To Conclude

Applying for a Barclaycard Visa in Germany is quick and straightforward when you meet the requirements and have prepared your details.

With the correct information, you can complete the process confidently in just a few steps.

Start your application today and take control of your finances with a reliable Visa card.

Disclaimer

Terms and offers may change. Always refer to barclaycard.co.uk for the most recent information.

This article is for informational purposes only and not financial advice.