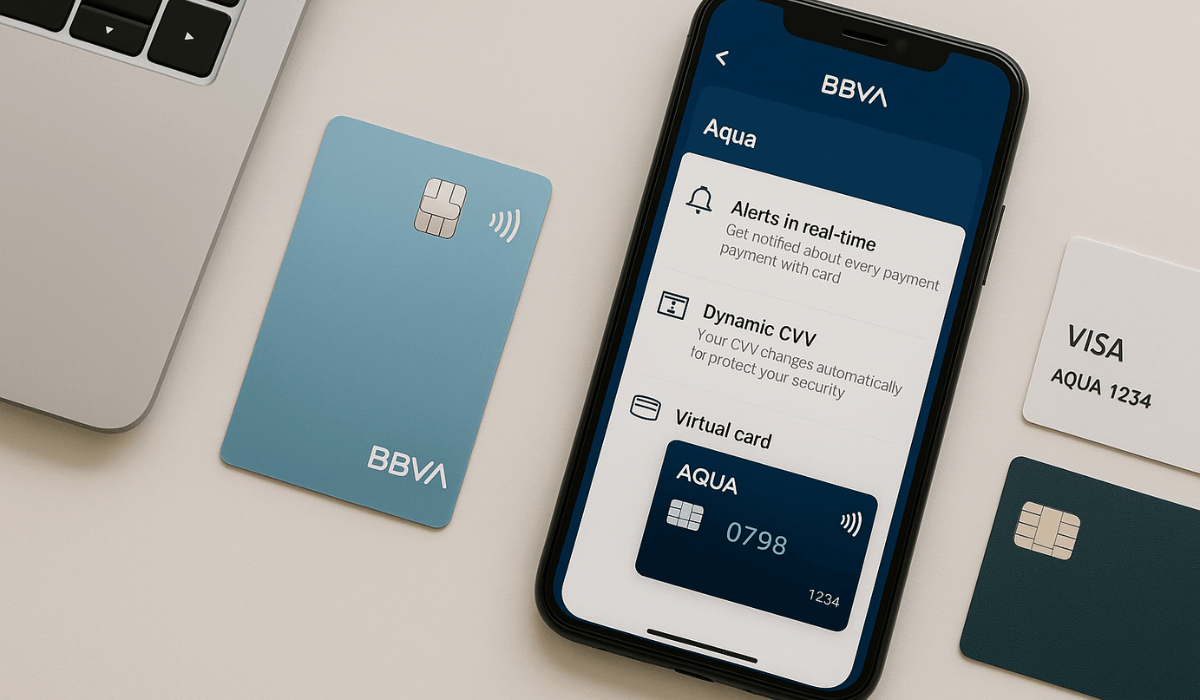

The BBVA Aqua Credit Card offers a secure, digital-first solution for managing your finances in Spain.

With no printed card number and a dynamic CVV, it prioritizes privacy and safety.

This guide explains how to apply, outlines the necessary documents, and highlights the key benefits you can expect.

Main Features of the BBVA Aqua Credit Card

The BBVA Aqua Credit Card is designed for security-first, mobile-savvy users in Spain.

It removes printed card data, utilizes a dynamic CVV, and provides complete control via the BBVA app. Check out its standout features below.

- Numberless design: No printed PAN (card number) or expiration date on the plastic.

- Dynamic CVV code: A new security code is generated for every transaction via the app.

- Zero issuance and maintenance fees: No annual cost to issue or maintain the card.

- Three-month interest-free financing: Split purchases over €50 into three monthly payments at 0% interest.

- Flexible payment options: Choose between full monthly payments or revolving credit with interest.

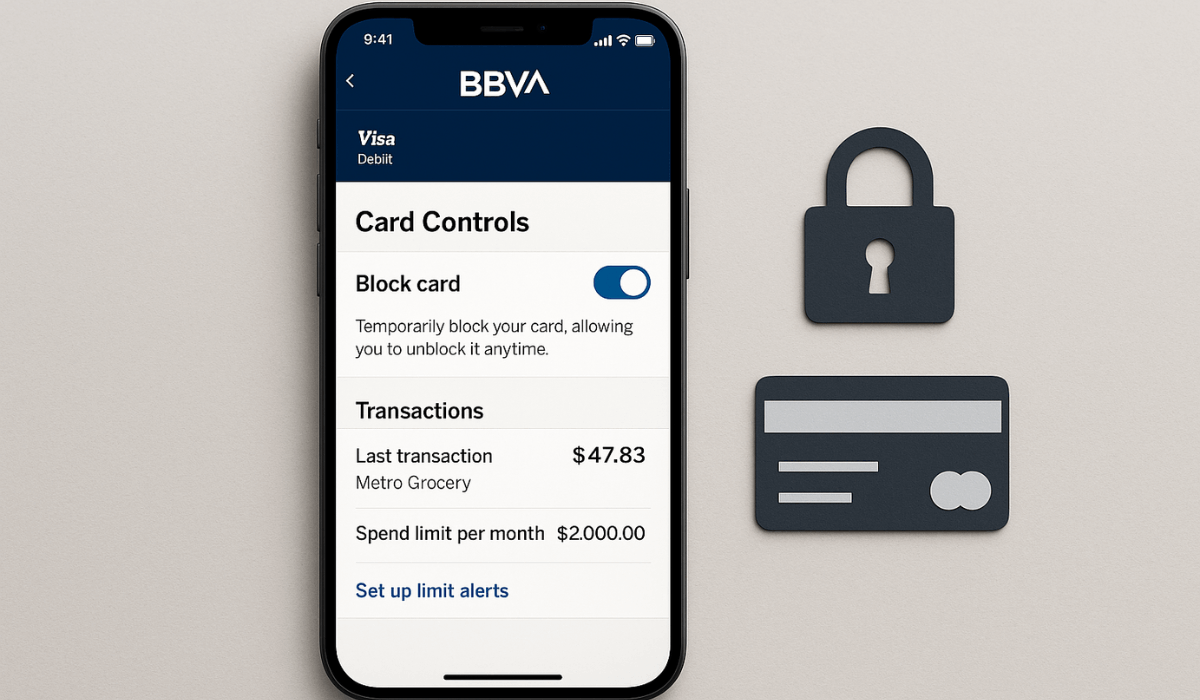

- Real-time app control: Enable or block your card, set spending limits, and get instant alerts.

- Purchase dispute support: File claims for unauthorized or disputed charges within 180 days.

- Optional travel pack: Add extra benefits for international use, starting at €2.99 per month.

- ATM robbery insurance: Covers theft of cash withdrawn at ATMs, up to €600 per incident.

- Eco-friendly card material: The card is made from recycled plastic for sustainability.

- Mobile payment ready: Fully compatible with Apple Pay, Google Pay, Samsung Pay, and contactless ATMs.

Interest Rates and Fees

Knowing the interest rates and fees helps you make smart financial decisions.

If you choose to defer payments or withdraw cash, specific charges apply. Here’s a clear breakdown of what you can expect.

- Purchase APR (TIN): Approximately 18.36% for deferred purchases.

- Annual Equivalent Rate (TAE): Ranges between 19.99% and 21.94%, depending on the payment method.

- Cash advance fee: Charged at 4.5% of the amount withdrawn, with a minimum of €3.

- Late payment fee: Additional interest and possible surcharges apply when payments are missed.

- Currency conversion fee: A fee of up to 3% may be charged for transactions made in non-euro currencies.

- ATM withdrawal fee: Extra charges may apply when using ATMs outside BBVA’s network.

- Revolving credit interest: Higher rates apply if you use the monthly revolving payment option within legal limits.

Eligibility Criteria

Before applying, make sure you meet the basic requirements.

These criteria help determine whether you’re qualified to hold and manage a credit card responsibly.

- Legal age: You must be 18 years or older.

- Spanish residency: Applicants must reside in Spain.

- Active bank account: A valid and active Spanish bank account is required.

- Proof of income: You must demonstrate financial stability, such as a regular salary, pension, or freelance income.

- Clean credit history: A positive credit report without recent defaults or outstanding debts is expected.

Documents to Prepare

Having the proper documents ready makes your application faster and smoother.

These are typically required for identity verification and financial assessment in Spain.

- Valid identification: A current DNI (for Spanish citizens) or NIE (for foreign residents).

- Proof of income: Recent payslips, pension documents, or freelance invoices showing stable income.

- Bank statement: A recent statement from a Spanish bank account to confirm financial activity.

- Email address: A valid email for receiving updates and digital contract copies.

- Mobile phone number: A working Spanish mobile number for identity verification and app setup.

How to Apply for the BBVA Aqua Credit Card

Follow these clear steps to complete your application efficiently. You’ll need your documents on hand and a stable internet connection.

- Access the platform: Visit BBVA’s official website or log into the BBVA mobile app.

- Select credit card option: Choose to apply for the “Aqua Credit Card” (look for secure, numberless cards).

- Enter personal details: Fill in your full name, address, DNI/NIE number, date of birth, and contact information.

- Provide financial info: Include data such as employment status, monthly income, and existing credit obligations.

- Upload documentation: Attach scans or photos of your ID, proof of income, and bank statements.

- Review terms and fees: Carefully read the interest rates, payment options, and any additional charges.

- Accept and submit: Agree to the terms electronically, verify your identity (via SMS/app), and submit your form.

- Monitor for confirmation: You’ll receive a confirmation by SMS or email within 1–3 business days, indicating your approval status.

Post-Application Process

After submitting your application, here’s what to expect next. These steps will guide you through the approval, delivery, and activation processes.

- Document & credit check: BBVA reviews your submitted documents and performs a creditworthiness assessment.

- Approval decision: You’ll get a decision by SMS or email within 24–72 hours.

- Digital card activation: If approved, your virtual card appears instantly in the app.

- Physical card delivery: Expect your plastic card to arrive by mail within 3–7 business days.

- Card activation: Activate the physical card via the app or phone; then it’s ready to use.

- Set preferences: In the app, configure your PIN, transaction limits, alerts, and usage settings.

Cardholder Benefits Beyond Basics

Aside from the core features, this card offers extra perks that enhance your financial experience.

These benefits go beyond the essentials and add long-term value.

- Flexible installment payments: You can split large purchases into manageable monthly payments directly through the app.

- Purchase protection: Eligible items bought with the card may include coverage against theft or accidental damage.

- Extended warranty: Some products may receive an automatic extension on manufacturer warranties when purchased using the card.

- BBVA Plan EstarSeguro: Access optional bundled services like insurance, budgeting tools, or premium support with flexible monthly fees.

- Exclusive partner discounts: Enjoy seasonal offers and discounts at select stores, travel sites, and entertainment providers.

- Eco-conscious rewards: By using a recycled plastic card and managing digitally, you support BBVA’s sustainability initiatives.

BBVA Customer Support

BBVA offers several support channels to help you with applications, card usage, or technical issues.

You can get assistance through phone, app chat, branches, or their official website.

- Phone support: Call 900 102 801 (toll-free in Spain) for general inquiries or card-related support.

- In-app chat: Use the secure chat feature within the BBVA mobile app for real-time assistance.

- Branch appointments: Visit a local BBVA branch and schedule an appointment online for in-person assistance.

- Email or message center: Send inquiries through the secure messaging section of the BBVA website or app.

- Social media presence: Reach out to BBVA via its official accounts on platforms like Twitter or Facebook for quick responses.

- 24/7 support: Some support services, including emergency card blocks, are available around the clock.

Conclusion: Start Using the BBVA Aqua Credit Card with Confidence

The BBVA Aqua Credit Card is a secure, flexible option designed for digital convenience and everyday use.

With features like dynamic CVV, zero annual fees, and complete app control, it meets the needs of modern cardholders.

Apply for the BBVA Aqua Credit Card today through the official app or website to take full control of your finances.

Disclaimer

Information provided in this article is for general guidance and may change based on BBVA’s policies or regulatory updates.

Always refer to the official BBVA website or contact customer service for the most current terms and conditions.