The Comdirect Credit Card is a popular choice in Germany for those who want a no-annual-fee Visa card with solid features.

Whether you’re a frequent traveler or an online shopper, this card offers flexibility, security, and convenience.

In this guide, you’ll learn exactly how to apply, what documents you need, and what to expect during the process.

What Is the Comdirect Credit Card?

The Comdirect Credit Card is a free Visa card designed for everyday spending, travel, and online purchases.

It’s directly linked to a Comdirect Girokonto, making it ideal for German residents who want simple, integrated banking.

Key Features

This card offers several practical benefits, making it a solid choice for everyday use. Here are the main features you should know:

- No annual fee – Completely free to use with no monthly charges

- Worldwide withdrawals – Free cash withdrawals at many ATMs abroad

- Visa network – Accepted globally for online and in-store purchases

- Linked to Girokonto – Seamless integration with your Comdirect checking account

- Mobile banking – Manage your card via Comdirect’s app or online portal

- Contactless payments – Tap to pay securely without entering your PIN

- Optional installment plans – Split purchases into manageable payments

- Strong security – Includes 3D Security and fraud alerts for safer transactions

Eligibility Requirements

Before you apply, make sure you meet the basic criteria set by Comdirect. These requirements help determine if you’re eligible for the credit card.

- Minimum age: You must be at least 18 years old.

- Residency: A permanent address in Germany is required.

- Bank account: You will need a Comdirect Girokonto (or you can apply for one during the process).

- Income: Proof of a stable monthly income is expected.

- Credit history: A positive SCHUFA score increases your approval chances.

- Documents: You must submit a valid ID, proof of address, and income verification.

Interest Rates and Fees

Here are the specific costs and charges you should be aware of before using the Comdirect Credit Card.

Understanding these fees helps you manage your card responsibly.

- Annual fee: €0 if you hold a standard Comdirect Girokonto

- Girokonto Plus: €1.90 monthly if you choose the upgraded account

- Purchase interest: 0% if full payment is made monthly via SEPA direct debit

- Foreign currency fee: 1.75% on transactions in non-euro currencies

- Cash withdrawals abroad: Free at many ATMs; third-party fees may still apply

- Installment plan fee: One free 3-installment plan per month; additional plans may cost €4.90 to €9.90

- Card replacement: €9.90 if your Visa card needs to be reissued

Step-by-Step Application Process

Here’s a clear path to follow—just a few simple steps to get your Comdirect Visa credit card.

- Visit Comdirect’s website and go to the credit card application section.

- Ensure you have a Comdirect Girokonto; if not, apply for one—they’re linked.

- Fill out the online form with personal, contact, employment, and income information.

- Upload the required documents, including ID, proof of address, and income verification.

- Choose the identity verification method—Video‑Ident or Post‑Ident at the post office.

- Submit your application and wait for confirmation (usually 3–5 business days).

- Receive your card by mail, typically within one week.

- Activate your card through the online banking portal or mobile app.

What to Expect After Applying

Once you’ve sent your application, here’s what happens next and how long each step typically takes:

Credit check and decision

- Comdirect reviews your SCHUFA and income.

- You’ll get approval or rejection, usually within 3–5 business days.

Application confirmation

- The bank sends you an email or letter confirming receipt and status.

Card production and shipment

- Once approved, your Visa card will be produced and mailed to you.

- Delivery usually takes 5–7 business days.

Activation instructions included

- The envelope includes steps for activation via online banking or the mobile app.

Account integration

- Your new credit card appears in your Comdirect account dashboard.

- You can start setting spending limits and exploring features.

First statement and payment schedule

- A monthly statement will show your due date.

- Set up SEPA direct debit to pay in full or via installment plans.

Common Application Problems and Solutions

Some applicants face minor issues during the card process. Here are the most common problems—and how you can quickly solve them:

Application Rejected: Your SCHUFA score may be too low, or your income doesn’t meet the requirements.

- Solution: Improve your credit, check document accuracy, and reapply after a few months.

Missing or Incorrect Documents: Files like your ID or proof of income may be incomplete or unclear.

- Solution: Double-check all uploads for clarity, expiration dates, and completeness.

Verification Delays: Video-Ident or Post-Ident may fail due to technical issues or ID mismatches.

- Solution: Retry Video-Ident or switch to Post-Ident; ensure your ID is valid and matches the information you provided.

Card Not Delivered: Delivery may be delayed due to postal service issues or an incorrect address.

- Solution: Confirm your address and contact Comdirect if it hasn’t arrived within seven business days.

No Confirmation Received: Sometimes, email confirmations are filtered into spam or delayed.

- Solution: Check your spam folder and verify the email details on your application.

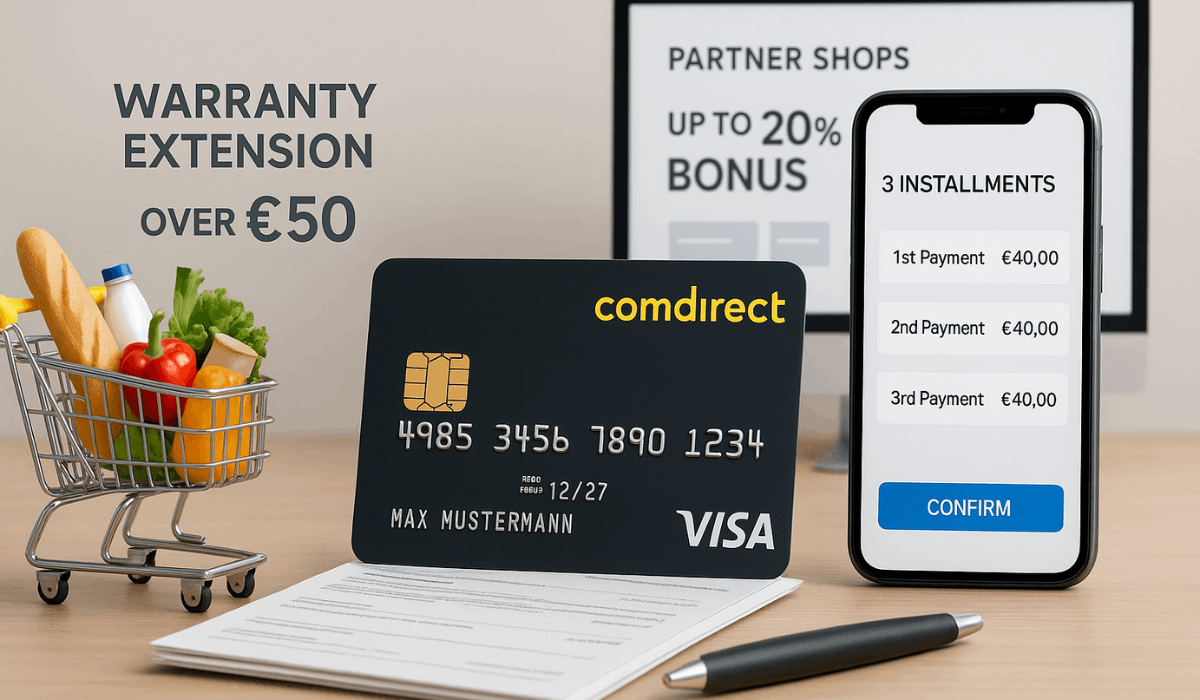

Rewards and Cashback Options

The Comdirect Credit Card offers more than just simple payments—it provides extra value through additional perks. Here’s how you can benefit:

- Warranty extension: 12-month extra warranty on €50+ buys. Pay 10% of the repairs (minimum €35), with a maximum of €2,000 per claim.

- 3-Installment payment plan: Split one €300+ purchase into three monthly payments with no additional fee. Extra uses may include a service charge.

- Bonus-Sparen offers: Earn up to 20% bonus on partner online shops. The bonus is automatically invested.

Comdirect Customer Support

Comdirect offers multiple ways to get help in Germany, including phone support, online chat, and in-app assistance.

Here’s how you can reach out and when:

24/7 Phone Hotline:

- General & card support: 04106 708 2500 (accessible around the clock)

- Card/blocking services: same number, 24/7

Comdirect First service (for high-net-worth clients):

- Phone: 04106 708 2502, Mon–Fri 8–22, Sat 10–18, Sun 14–22

Email & Online Contact Form:

- General inquiries: [email protected]

- Privacy-specific: [email protected]

- Encrypted form available via online banking

Live Chat:

- Access through online banking after obtaining a security code via phone

In-App Support:

- Contact via phone or email ([email protected]) directly from the mobile app

Fax & Postal Mail:

- Fax: 04106 708 2585 or 04106 708 2580

- Mail: comdirect, Pascalkehre 15, 25451 Quickborn

The Bottomline

Applying for a Comdirect Credit Card is simple if you meet the basic requirements and follow each step carefully.

With no annual fee and valuable features, it’s a strong choice for everyday use and travel.

Start your application today by visiting the official Comdirect website and submitting your details online.

Restate that applying is simple if you meet the criteria.

Disclaimer

Card features, interest rates, and fees are subject to change at any time based on Comdirect’s policies.

Always check the official Comdirect website for the latest terms and conditions before applying.