The EVO Smart Card is a modern credit card designed specifically for residents in Spain who want complete control through their smartphones.

It combines app-based management, zero annual fees, and real exchange rates for international spending.

This guide walks you through the application process, outlines the requirements, and explains what to expect after your application is approved.

What Is the EVO Smart Card?

The EVO Smart Card is a credit card issued by EVO Banco for residents in Spain.

It’s available in both physical and digital formats, providing flexibility for both online and in-store use.

The card is fully managed through the EVO Banco app, offering complete control over spending and settings.

Key Benefits

Here are the key benefits that make the EVO Smart Card a strong choice for everyday use and digital banking in Spain:

- No Annual Fee: You won’t pay a yearly maintenance fee to keep the card active.

- Virtual and Physical Versions: Use it instantly online with the virtual card while you wait for the physical one.

- Real-Time Notifications: Get instant alerts for every purchase or transaction.

- Real Exchange Rates for Travel: Save money abroad with no added currency conversion fees when travel mode is enabled.

- App-Based Management: Control spending limits, activate or freeze the card, and track expenses—all from the EVO Banco app.

- Mobile Payment Support: Fully compatible with Google Pay, Apple Pay, and Samsung Pay.

- Automatic Credit Limit Review: EVO may increase your credit limit after you have consistently used it responsibly.

How to Apply – Simple and 100% Online

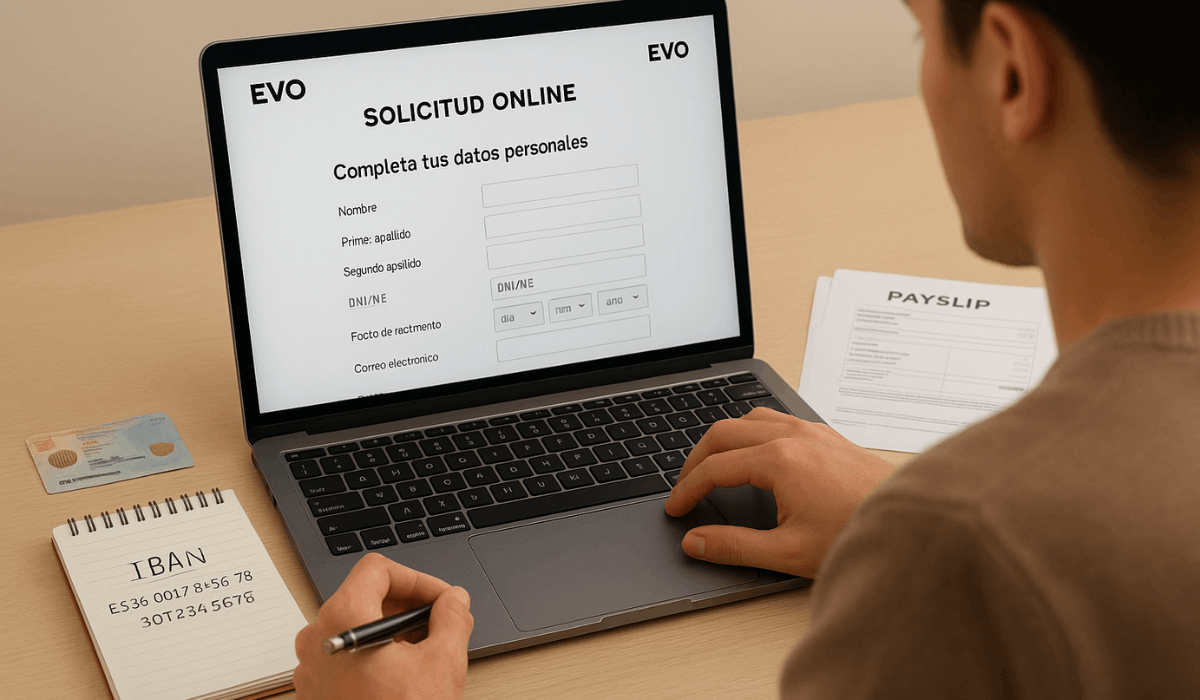

Applying for the EVO Smart Card is fast, entirely online, and requires just a few essential documents.

Here’s a step-by-step list to help you complete the process with ease:

- Visit the EVO Banco Website or App: Begin by accessing the official site or downloading the EVO Banco app.

- Select “Solicitar Tarjeta Smart”: Choose the EVO Smart Card from the card options.

- Fill out the Application Form: Enter your details, including your full name, address, phone number, and email.

- Provide Identification: Upload a valid Spanish ID (DNI or NIE) and a selfie for identity verification.

- Submit Financial Information: Provide proof of income, such as a payslip, bank statement, or tax return, as requested.

- Verify Your Identity: Complete the process with a live video call or automatic verification through the app.

- Submit and Wait for Approval: Submit your application and get a response within 1–2 business days.

Interest Rates and Card Fees

Here are the specific interest rates and fees for the EVO Smart Card—clear and fully transparent so you know exactly what to expect:

- Revolving Credit APR: 19.99 % TAE (18.36 % TIN) applies if you choose to pay over time.

- 0% Interest Option: Pay your full balance within 30 days and avoid all interest charges.

- Annual Fee: €0—no cost to keep the card active.

- Non-EVO ATM Withdrawals: €1.50–€2.00 per transaction.

- Foreign Currency Transactions: 0% currency conversion fee when travel mode is activated.

These terms are specific as of today—always double-check the EVO Banco app or website for the latest updates.

After You Apply – What Happens Next

Once you complete the application, the following steps are quick and mostly handled online. Here’s what you can expect after submitting your details:

- Approval Time: Most applicants get a decision within 1–2 business days.

- Virtual Card Access: If approved, you’ll receive a digital version right away through the app.

- Physical Card Delivery: The physical card is sent by mail and usually arrives within 5–7 business days.

- Activation: Use the app to activate your card, set your PIN, and configure preferences.

- First-Time Setup: Customize spending limits, enable travel mode, and link the card to your mobile wallet.

Unique Features You Might Overlook

Beyond the standard features, there are a few unique tools and perks that many users miss.

These extras make daily card management smoother and more flexible:

- Travel Mode with Real Exchange Rates: Activate travel mode in the app to pay abroad with no added currency fees.

- Automatic Credit Limit Adjustments: EVO may raise your credit limit based on responsible usage without needing a request.

- Smart Spending Reports: Monthly breakdowns by category help you easily track personal or business expenses.

- Card Freeze and Unfreeze: Temporarily deactivate your card in seconds if it’s lost or stolen, then reactivate it at any time.

- Custom Alerts: Set up personalized notifications for spending, withdrawals, or approaching limits.

- Online Purchase Control: Enable or turn off online transactions instantly for added security.

Security Features That Protect You

Your EVO card includes built-in tools to help prevent fraud and keep your account secure.

- Instant Freeze Option: You can lock or unlock your card immediately through the EVO app.

- Two-Factor Login: To access your account and transactions, secure two-step verification is required.

- Purchase Notifications: Every transaction sends a push alert to your phone.

- Online Purchase Controls: You can disable online use at any time to prevent unauthorized charges.

- Daily Use Limits: Establish your spending and withdrawal limits to minimize risk.

How the EVO Smart Card Works for Online Shopping

The card is designed for safe and flexible use in online stores across Spain and beyond.

- Virtual Card Access: Use the card digitally immediately after approval without waiting for the physical one.

- App-Based Management: Control online purchases, spending caps, and merchant settings in real-time.

- Secure Payment Gateways: EVO utilizes trusted gateways with enhanced verification procedures.

- Disable Online Use: Instantly turn off e-commerce access if needed.

- Track Online Expenses: All digital purchases are clearly labeled and easily reviewed in monthly summaries.

Can You Use It Without Opening a Full EVO Bank Account?

Many users ask if the card can work without switching banks. Here’s how EVO handles that.

- EVO Account Is Required: You must open a free EVO Cuenta Inteligente to use the card.

- No Salary Deposit Obligation: You don’t need to switch your payroll or direct deposit.

- No Maintenance Fee: The linked account incurs no monthly or annual fees.

- Full App Access: You manage both the card and account from one app dashboard.

- Quick Account Setup: The EVO account can be opened in minutes using your phone and ID.

Support Channels You Can Rely On

Here are the reliable support options available when you need help or assistance:

- In-app Chat: The fastest way to get support is through the EVO Banco app’s chat feature, which is available 24/7.

- Customer Service Phone: You can call EVO Banco at 900 813 846 for queries, complaints, or card support issues.

- Another line listed is 91 090 09 00, used for general contact

- In-app Chat: According to the Google Play store, the EVO Banco app includes a chat feature and offers email support via [email protected]

- Email & Help Center: Access FAQs and detailed guides, and submit support tickets via the EVO Banco website.

- Language Support: Primary support in Spanish, with limited English assistance available for common queries.

- Social Media Updates: Stay informed about outages or maintenance on EVO’s official Twitter and Facebook pages.

The Bottomline

The EVO Smart Card offers a simple, no-fee way to manage your finances entirely from your phone.

With flexible features, innovative tools, and complete control via the app, it’s built for everyday use in Spain.

If you meet the basic requirements, apply online today and start using your virtual card within minutes.

Disclaimer

The information in this article is for general guidance and may be subject to change.

Always check the official EVO Banco website or contact their support team for the most up-to-date terms and conditions.