The Iberia Icon Credit Card by Santander is designed for frequent travelers in Spain who want to earn rewards while enjoying exclusive flight benefits.

This card offers access to the Iberia Plus program, flexible payment options, and travel-related perks.

In this guide, you’ll learn how to apply, what to expect, and how to maximize its features.

Main Features and Benefits

The Iberia Icon Credit Card offers a mix of travel rewards, exclusive privileges, and flexible financial tools.

This section outlines the most essential features you’ll receive as a cardholder.

- Earn Avios on Purchases: Get rewarded with Avios points for every euro you spend, especially on Iberia flights and partner services.

- Iberia Plus Silver Status: Enjoy automatic Silver tier benefits, including priority check-in and boarding.

- Free Checked Luggage: One free checked bag on eligible Iberia flights, helping you save on travel costs.

- Priority Boarding and Seat Selection: Access to early boarding and preferred seating options when flying with Iberia.

- Flexible Payment Options: Choose to pay in full or in monthly installments with tailored interest rates.

- Travel Insurance: Includes basic travel coverage such as delays, baggage loss, and accidents.

- Global Mastercard Acceptance: Use your card worldwide wherever Mastercard is accepted.

- Santander Digital Banking Access: Manage your card, view Avios balance, and control settings through Santander’s mobile app.

Interest Rates and Fees

Understanding the cost structure is essential before applying. This section highlights the exact rates and fees you may encounter as a cardholder in Spain.

- Annual Interest Rate (APR): Around 18.36% for revolving credit (may vary based on credit profile and approval).

- Annual Card Fee: Typically €90 per year, charged regardless of usage.

- Deferred Payment Option: Monthly installments are available with standard APR applied to the balance.

- Cash Withdrawal Fee: 4.5% of the amount withdrawn, with a minimum of €3.50 per transaction.

- Foreign Transaction Fee: 3% of the amount converted for purchases made in non-euro currencies.

- Late Payment Fee: May be charged if the minimum monthly payment is not made on time (exact fee varies by case).

- Card Replacement Fee: A small administrative fee may be applied for the replacement of a lost or stolen card.

Eligibility Requirements

Before applying for the card, make sure you meet some essential criteria in Spain.

These are the criteria:

- Age: You must be at least 18 years old.

- Residency: Must hold a valid DNI (Spanish national ID) or NIE (foreigner ID) and reside in Spain.

- Income Proof: Have a steady income, such as a salaried job or documented freelance earnings.

- Bank Account: Maintain an active Santander account in your name.

- Credit Standing: Show a clean credit record with no recent defaults or negative entries.

- Employment Verification: Provide proof of stable employment or regular freelance work.

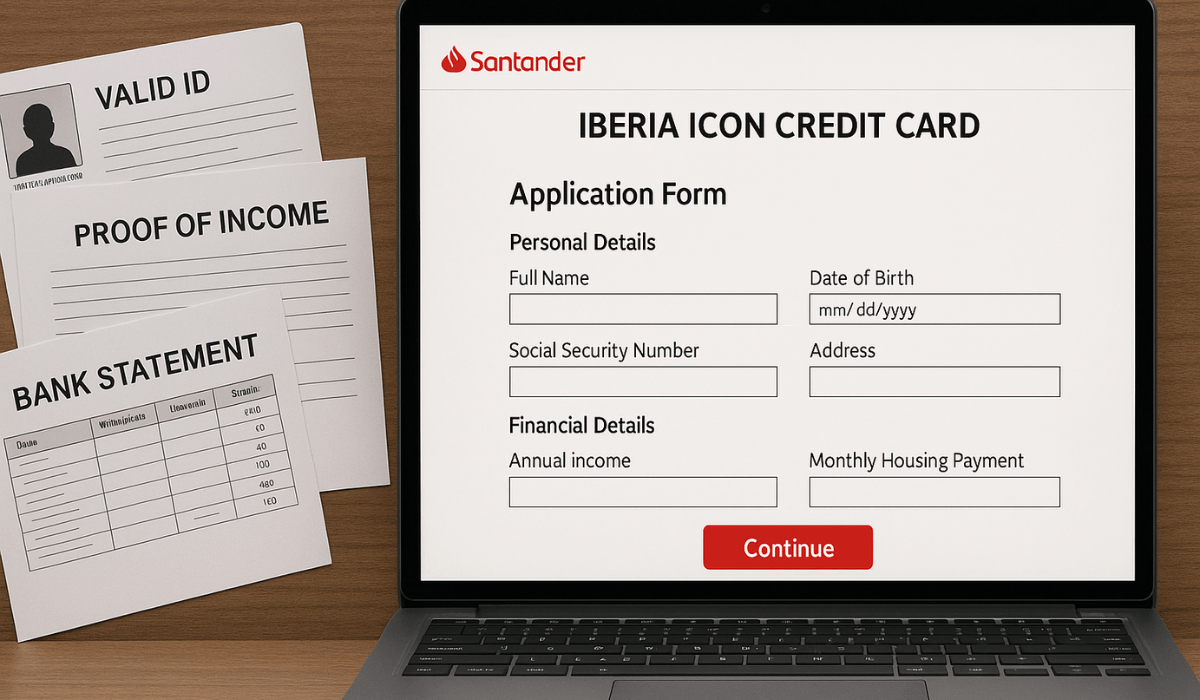

Step-by-Step Application Process

Follow these clear steps to apply for the Iberia Icon Credit Card. It’s simple whether you apply online or at a branch.

Start Online or In‑Branch

- Online: Go to Santander Spain’s website, find “Iberia Icon,” and click “Apply.”

- In-branch: Book an appointment or walk into a nearby Santander office.

Fill in Personal & Financial Info

- Provide your name, address, DNI/NIE, contact details, employment status, and income.

Upload Required Documents

Attach or present:

- DNI/NIE (both sides)

- Proof of income (payslips or tax documents)

- Santander bank account details

Review & Submit

- Check all details, accept the terms and conditions, and then submit.

Await Review

- Santander reviews your credit history and documents.

- Expect a decision in 1–3 business days.

Receive Your Card

- If approved, the card will be mailed to you within 7–10 days.

- You may get a notification when it ships or is ready for pickup.

Activate & Set Up

- Activate via Santander’s online banking or phone.

- Set your PIN and enable security features, such as transaction alerts.

Start Using

- Begin using your card for purchases, earning Avios, and accessing travel perks immediately.

What Happens After You Apply

After submitting your application for the card, here’s what to expect in the following stages: clear, concise, and practical:

Application Review

- Santander reviews your credit history, income, and documents.

- Expect a decision within 1–3 business days, depending on volume.

Initial Notification

- You’ll receive an email or SMS confirming whether your application is approved, under review, or rejected.

Card Issuance & Mailing

- Once approved, the card is typically mailed within 7–10 business days.

- Some users report that it can arrive faster, depending on the postal service and bank processing.

Iberia Plus Linking

- Santander links your new card to your Iberia Plus account.

- Look out for an email confirmation, or check your Iberia Plus dashboard to confirm the linkage.

Activation & First Use

- Activate your card via Santander online banking or by calling.

- Also, set your PIN and security preferences, such as alerts.

- Once active, you can start earning Avios and enjoy full travel perks.

Tips to Improve Approval Chances

Boosting your approval chances is easier with the right preparation. Focus on financial stability and accurate documents to strengthen your application.

- Maintain a Good Credit Score: Avoid missed payments and recent defaults in Spain.

- Show Stable Income: Provide clear proof like pay slips or tax returns.

- Use a Santander Account: An active account in good standing helps.

- Limit Credit Applications: Too many recent requests can lower approval odds.

- Check Your Info: Review all details to avoid delays or rejections.

- Keep Debt Low: A low debt-to-income ratio builds lender confidence.

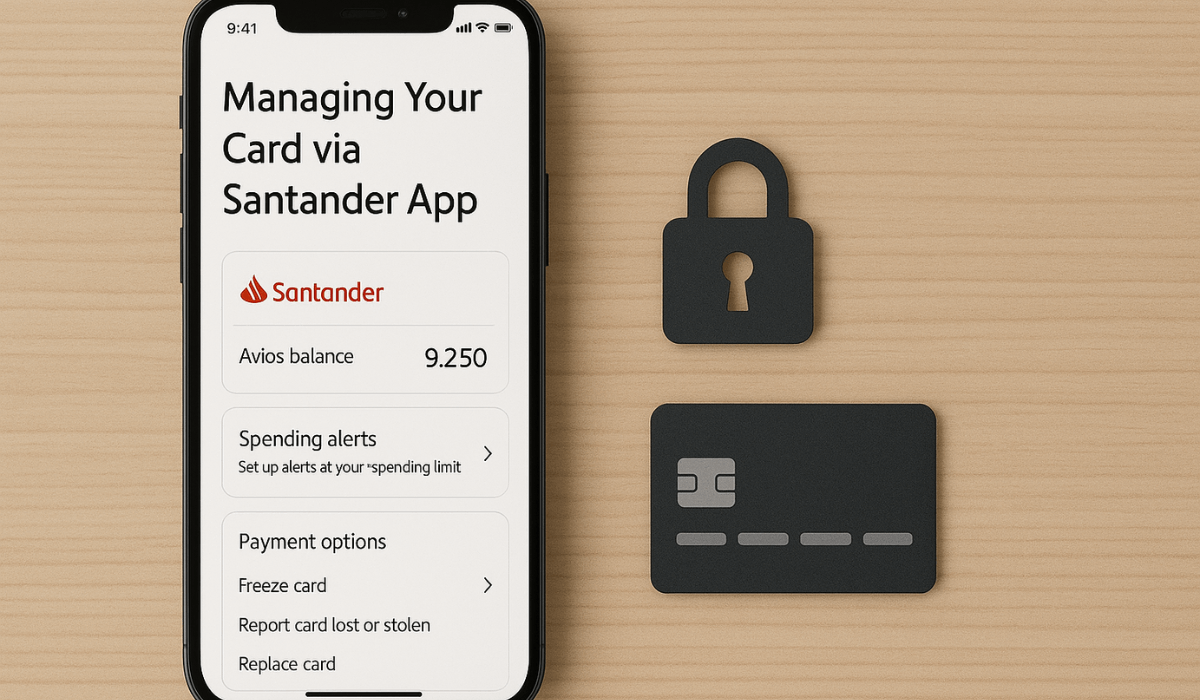

Managing Your Card via the Santander App

Once activated, you can easily manage your card using the Santander app. Here’s what you can do from your phone:

- Check Your Balance and Transactions: See your credit limit, purchases, and pending charges in real time.

- Track Avios Accumulation: Check how many Avios points you’ve earned and when they were added.

- Pay Your Monthly Bill: Make payments, schedule due dates, or choose installment options.

- Set Security Alerts and Limits: Turn on spending alerts and set purchase or withdrawal limits.

- Lock or Replace Your Card: Block a lost card and request a replacement in just a few taps.

- Manage Card Settings: Update your PIN, activate your card, and view Iberia Plus details.

Contact and Support Channels

Need help or have questions about your card? Here’s a list of reliable ways to get support in Spain, whether you’re online, on the phone, or visiting a branch:

Santander Customer Service (General & Credit Cards)

- Call 915 123 123 for daily support. You can also submit issues using the online form — expect a reply within 2 business days.

In‑Branch Support

- Visit any Santander branch for face-to-face help. It’s best to book an appointment in advance.

Email for Complaints

- Send formal feedback or complaints to [email protected], or mail them to P.O. Box 35 250, 28080 Madrid.

Corporate & Shareholder Contact

- For general inquiries in Spain, call 902 11 22 11, or use the main international line +34 912 890 000.

Iberia Cards Support

- If your question relates to Iberia flight benefits or linking your Avios, call 91 334 21 50 from within Spain (same number from abroad).

WhatsApp & Social Media

- Reach out to Iberia customer service via WhatsApp at +34 676 67 60 04, or message them on Twitter or Facebook at @iberia.

Conclusion – Start Earning Avios with Iberia Icon

The Iberia Icon Credit Card offers a strong combination of travel rewards, flexible payment options, and exclusive Iberia perks for residents of Spain.

With proper preparation, applying is quick and provides you with access to valuable Avios benefits.

Apply today through Santander’s website or your nearest branch to start enjoying your travel advantages.

Disclaimer

Terms, conditions, and eligibility criteria for the Iberia Icon Credit Card are determined by Santander Spain and are subject to change without notice.

Always review the official Santander website or consult a bank representative before making an application.