Revolut offers a modern alternative to traditional banking, particularly for users in countries such as Germany.

If you’re looking to apply for a Revolut credit card, this guide will walk you through everything you need to know.

From eligibility to card features and fees, here’s how to get started.

What Is the Revolut Credit Card?

The Revolut credit card is a digital-first credit solution available in select countries, including parts of Europe like Germany.

It’s fully managed through the Revolut app, giving you real-time control over spending, limits, and security.

Key Features

Here are the key features that make the Revolut credit card a practical choice for digital-savvy users.

These benefits are designed to give you convenience, control, and flexibility.

- No annual fee in most supported countries

- Real-time notifications for every transaction

- Spending insights with automatic categorization

- Virtual and disposable cards for online safety

- Freeze and unfreeze the card instantly via the app

- International use with competitive exchange rates

- Optional cashback and perks (varies by plan and region)

Who Can Apply for the Revolut Credit Card?

Here’s who can apply. Make sure you meet these conditions before starting your application:

- Must be at least 18 years old.

- Live in a supported country, such as Germany or other parts of Europe.

- Have a verified personal account in the app.

- Meet credit or income requirements, depending on your region.

- Use an eligible plan tier, if required (Standard, Plus, Premium, or Metal).

How to Apply for the Revolut Credit Card

Here’s how to apply. Just follow these steps in the app:

- Download and verify your account – Install the app, complete identity checks, and choose your plan.

- Go to the Cards section – Tap “Cards” in the app menu.

- Select the credit card option – If it’s available in your country and plan.

- Complete the application form – Provide the requested income and personal information.

- Submit and wait for approval – Revolut may perform a credit check; approval is often instant.

- Activate your physical or virtual card – Once approved, it typically arrives within 5–9 business days; activation can be completed through the app.

Common Application Issues and Fixes

Here are common issues users face when applying, along with quick solutions. Knowing these in advance can help you avoid delays or confusion.

- Card option not visible – Your region or plan might block the feature. Try changing your location or upgrading your account to resolve the issue.

- Application rejected – Your credit profile may not meet current requirements. Improve your credit or wait 30 days before reapplying.

- App not updated – Using an outdated app version can cause missing features. Update the app to the latest version.

- Verification issues – ID checks may fail due to unclear photos or incorrect info. Re-upload clear, valid documents.

- Incorrect address – Mistyped addresses can cause delays in delivery. Always double-check your input before submission.

- No response after applying – Some cases require manual review. Contact Revolut support via the app if there is no update after three business days.

Interest Rates and Applicable Fees

Here’s a clear summary of the interest rates and applicable fees for the Revolut credit card:

Interest Rates & Charges

- APR (Variable): Typically around ~16–18 %, e.g., 16.08 % in Lithuania and 17.99 % in Ireland.

- Installment purchases: A lower rate (~9.50%) for items over €50, spread across 3–12 months (Ireland).

- Late payments: Incurs a fixed fee (e.g., €10) plus interest on overdue balance (~1 % per month or regional rate).

Transaction-Related Fees

- No fee for purchases in your base currency.

- Foreign currency spending: Applies fair usage and FX markup — e.g., Standard plan: 0.5 % after €1,000/month, plus a 1 % weekend surcharge.

- ATM withdrawals (cash advances): e.g., Standard plan: free up to €200/month or 5 ATM withdrawals, then 2%, min. €1.

Card Issuance & Delivery Fees

- Physical cards: Standard/Plus plan—€5.99 per extra card; Premium/Metal—€39.99; Ultra—€49.99.

- Delivery: Standard shipping ~€6–8; express ~€19.99 .

- Virtual cards: Free of charge

Card Limits and How They Work

Here’s how card limits work and what affects them. These limits help you manage your credit responsibly while staying within Revolut’s risk guidelines.

- Based on your credit profile – Your limit is calculated using your credit score, income, and spending history.

- Set during approval – You’ll see your assigned limit right after approval in the app.

- Viewable anytime in the app – The limit is shown clearly under your card details.

- Can be adjusted – You may request an increase after consistent on-time payments.

- Plan level may influence limits – Higher-tier plans, such as Premium or Metal, may offer higher limits.

- Revolut monitors your usage – Responsible usage may lead to automatic limit increases.

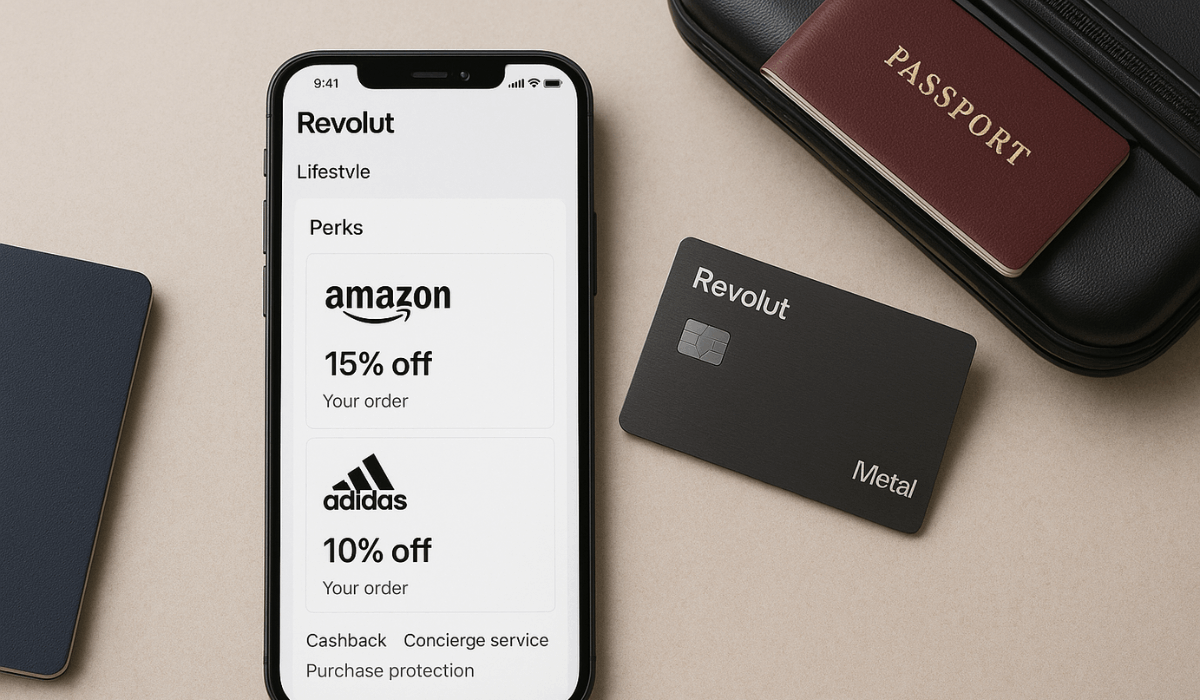

Rewards and Benefits Program

Here’s a look at the rewards and benefits you may receive. These vary based on your country and Revolut plan, but can add extra value to your spending.

- Cashback on purchases – Metal plan users can earn up to 1% cashback on card payments (varies by region).

- Partner offers – Discounts and deals with brands available through the app’s “Lifestyle” or “Perks” sections.

- Travel insurance – Included with Premium and Metal plans; covers medical emergencies, trip delays, and lost baggage.

- Lounge access – Metal and Ultra users get access to over 1,000 airport lounges worldwide.

- Purchase protection – Eligible plans offer refund support for damaged or stolen items.

- Concierge service – Available to Metal and Ultra users for booking travel, dining, and more.

Revolut Credit Card vs Traditional Credit Cards

Here’s how this card compares with traditional credit cards. These points highlight the key differences in usability, control, and benefits.

- App-based management – Fully controlled through your phone with instant updates and security tools.

- No paperwork – No physical bank visits, mailed statements, or manual applications.

- Transparent fees – Clear, upfront info with fewer hidden charges than many banks.

- Real-time tracking – Immediate spending alerts and budget tools built into the app.

- Instant freeze/unfreeze – Pause or reactivate your card anytime with one tap.

- Faster approvals – Most applications are reviewed and approved within minutes.

Contact Information

Here’s how to contact Revolut for support or inquiries. These are the main channels you can use:

In-app chat (24/7)

- Open your app → tap your profile icon → select Help → choose a topic → tap Chat with us.

Email support

- General support: [email protected]

- Formal complaints (Germany): [email protected]

- Feedback: [email protected]

Automated phone lines

- International (e.g., Germany/UK/India): +44 20 3322 8352

- US & others: (844) 744‑3512 (fees may apply)

Conclusion – A Smart Choice for Modern Credit Users

The Revolut Credit Card provides a fast and flexible way to access credit with complete control from your phone.

If you meet the basic requirements, applying takes just a few minutes.

Download the app today and check your eligibility to get started.

Disclaimer

The information provided in this article is for general guidance and may vary depending on your country and Revolut account type.

Always review the latest terms and conditions directly in the Revolut app before applying.