The Visa Tú Card from Abanca is a flexible credit card designed for everyday purchases and secure online shopping.

It offers digital tools, manageable payment options, and no unnecessary fees for standard use.

This guide explains how to apply, what to expect, and the benefits you can access.

What Is the Visa Tú Card from Abanca?

The Visa Tú Card is a credit card from Abanca that allows flexible monthly payments.

It’s issued by Abanca, a well-established bank in Spain known for accessible digital banking.

This card is ideal for secure and manageable spending on a daily basis.

Features of the Visa Tú Card

The Visa Tú Card offers a range of features that make spending easy, secure, and tailored to your needs.

It combines convenient digital access with smart payment controls and protection tools.

- Contactless Payments – Tap to pay quickly in stores without needing to insert your card.

- Chip & PIN Security – Protects you from fraud and unauthorized use.

- International Acceptance – Works anywhere Visa is accepted, online and offline.

- Customizable Spending Limits – You can adjust your limits via the app or online.

- Real-Time Alerts – Get instant notifications for each transaction.

- Digital Card Access – Use a virtual version of your card instantly after approval.

- Online and Mobile App Integration – Manage payments, view statements, and track expenses easily.

- Contactless ATM Withdrawals – Take cash from ATMs without inserting your physical card.

Interest Rates and Fees

Knowing the interest rates and fees helps you avoid extra costs when using your card. They affect what you pay if you carry a balance or miss payments.

- Annual Percentage Rate (APR): Around 19.84% for revolving credit, subject to updates by the bank.

- Interest-Free Period: Up to 40 days if the full balance is paid on time.

- Issuance/Maintenance Fee: Often free, but may vary based on your account type or promotional terms.

- Cash Withdrawal Fee: Charges may apply when using non-Abanca ATMs or withdrawing cash on credit.

- Late Payment Fee: Applied if you fail to make the minimum required payment by the due date.

- Currency Exchange Fee: A small percentage may be charged for purchases made in non-euro currencies.

Benefits of the Visa Tú Card

This card offers practical benefits that support easy spending, greater control, and peace of mind—perfect for both daily use and occasional splurges.

- Flexible Repayment Options – Choose to pay the full balance monthly or spread payments across several months.

- Purchase Protection – Covers eligible purchases against damage or theft.

- Wide ATM Access – Withdraw cash at Abanca and partner ATMs throughout Spain and abroad.

- Travel and Fraud Protection – Offers added security when you’re on the move.

- Real-Time Transaction Alerts – Stay informed with instant notifications for every charge.

- Digital Convenience – Manage your spending via the app, set up limits, and control payments.

- Promotional Offers – You may receive discounts, cashback, or partner promotions.

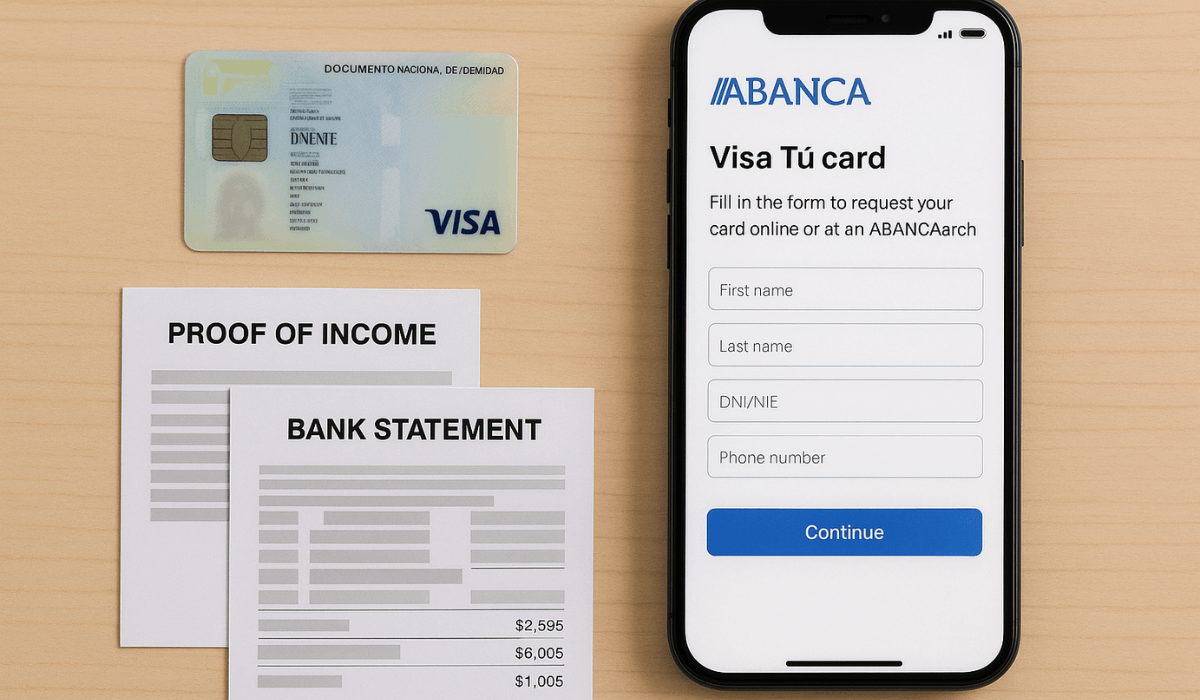

Who Can Apply?

The Visa Tú Card from Abanca is available to users who meet basic requirements and provide the required documents.

- Spanish Residents (DNI/NIE): Applicants must live in Spain and hold a valid national identity document.

- Minimum Age: You must be at least 18 years old.

- Income or Creditworthiness: Demonstrate a reliable income or sufficient credit history through pay slips or bank statements.

- Valid ID: Provide a current DNI (for Spanish citizens) or NIE (for foreign residents).

- Proof of Address: Show recent utility bills or bank statements confirming your home address.

How to Apply for the Visa Tú Card

Applying for the Visa Tú Card from Abanca is a straightforward process that can be completed online or in person. Here’s how to go about it:

Online Application

- Visit Abanca’s official website or open the mobile app.

- Log in or register for a client profile.

- Complete the digital application form with your personal and financial details.

- Upload documents: ID (DNI/NIE), proof of address, and income evidence.

- Submit your application and wait for a confirmation message.

In-Person at a Branch

- Locate your nearest Abanca branch.

- Bring your documentation: ID, proof of address, and income proof.

- Fill out a physical application form with a bank advisor.

- Submit your form and receive confirmation of your application.

What to Expect After Applying

After submitting your application, the bank will review your information and notify you of the outcome.

The process is generally quick and can be tracked digitally.

- Application Review: Usually processed within 1 to 5 business days.

- Notification: You’ll receive updates via email, SMS, or through the Abanca app.

- Card Approval: If approved, your account will be activated, and a digital card may be issued immediately.

- Card Delivery: The physical card is sent to your registered address, typically within 5-10 business days.

- PIN and Activation: Instructions for activation and PIN setup will be included with the card.

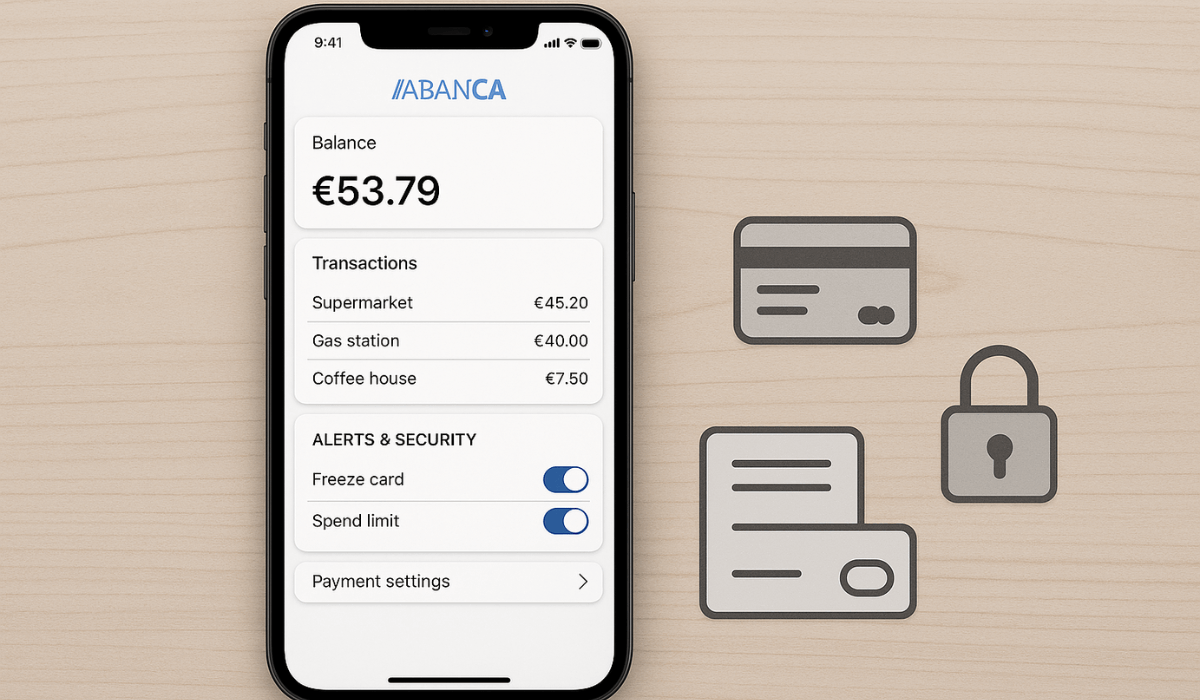

Managing Your Card via the Abanca App

The Abanca app helps you stay in control of your Visa Tú Card with simple, secure tools.

Here are seven ways to manage your card directly from your phone.

- View Balance & Transactions: Instantly check your balance, recent purchases, and payment history.

- Make or Schedule Payments: Pay in full or set up installment plans, future payments, or recurring transfers.

- Set Spending Limits: Adjust your daily or monthly limits for both purchases and withdrawals.

- Activate or Freeze the Card: Temporarily deactivate your card if it’s lost or stolen, then reactivate anytime.

- Enable Transaction Notifications: Get real-time alerts for every purchase or ATM withdrawal.

- Manage Virtual Card: Use a digital version of your card for safe and quick online shopping.

- Enable Online & Contactless Payments: Turn these features on or off anytime for added control and security.

Tips to Use the Visa Tú Card Effectively

Using your Visa Tú Card wisely can help you avoid unnecessary fees and maximize its features.

Here are some simple tips to manage your card effectively.

- Pay Your Balance in Full: Avoid interest by clearing your balance within the interest-free period.

- Use the App Regularly: Monitor transactions, set spending limits, and stay updated in real-time.

- Set Up Alerts: Enable notifications for every purchase to quickly detect unauthorized activity.

- Avoid Cash Advances: Limit cash withdrawals to emergencies, as they may incur additional fees.

- Use the Digital Card for Online Purchases: Enhance security by using a virtual card instead of a physical one when making online purchases.

- Track Offers and Promotions: Check the app or website for partner discounts or cashback opportunities.

- Report Issues Immediately: Use the app or call support to freeze the card if it’s lost or compromised.

Abanca Customer Support

Abanca offers multiple support channels to assist with applications, account management, and security-related issues.

Phone Support

- Call +34 981 910 522 for assistance in Spanish or English.

- Available during standard banking hours for immediate help.

In-App Chat & Messaging

- Use the Abanca mobile app to access live chat with support agents.

- Send messages anytime for quick answers or document uploads.

Email & Secure Online Messaging

- Reach out through your Abanca web portal’s secure messaging feature.

- It is ideal for non-urgent questions or when attaching documents.

Branch Support

- Visit any Abanca branch for face-to-face assistance with applications, troubleshooting, or personalized advice.

Online Help Center

- Explore FAQs, tutorials, and step-by-step guides on Abanca’s official website.

- Covers topics such as card activation, payment setup, and fraud protection.

The Bottomline

The Visa Tú Card offers flexibility, digital control, and valuable benefits for everyday spending.

With simple eligibility requirements and easy application methods, it’s a practical option for users in Spain.

If it fits your needs, apply today through the Abanca website or visit your nearest branch.

Disclaimer

This article provides general guidance and may change with Abanca’s policies. Check their website or contact support for the latest terms.