The WiZink Plus Mastercard offers a convenient and rewarding way to manage your everyday spending in Spain.

With no annual fees and cashback on select categories, it’s a popular choice for users seeking flexibility and value.

This guide explains the full application process, including eligibility requirements and what to expect after you apply.

Main Features

The WiZink Plus Mastercard gives you strong rewards and flexibility without annual fees.

It’s designed for everyday users in Spain who want cashback, convenient payment options, and insurance benefits.

- No annual or maintenance fee: Enjoy the card without paying yearly charges.

- Cashback rewards: Earn 3 % cashback on two categories of your choice (like travel or fashion), up to €6/month (€72/year).

- Flexible payment options: Choose how to pay—full balance, fixed monthly amount, or flexible installment plans.

- Insurance and purchase protection: Comes with purchase insurance and travel assistance for added security.

- Exclusive promotions: Access unique Mastercard offers and discounts at partner stores.

- App-based control: Manage your card digitally—activate, block, track spending, and set alerts via the WiZink app.

Interest Rates & Fees

This card is free of annual charges; however, interest and fees may apply if you don’t pay in full or use certain features.

Understanding these costs helps you make informed use of the card.

Purchase Interest (Revolving TIN/TAE)

- Nominal TIN (annual interest rate): around 19–21 %

- Annual percentage rate (TAE): often above 21 %, typically between 21–23 %

Default / Usury Risk Rates

- Spanish courts have flagged revolving credit TAE at ~26.8 % as potentially usurious.

Cash Advance Fee

- 3–5 % of the withdrawn amount (minimum ~€5)

- Interest begins accruing immediately at a higher APR than purchases

Foreign Currency Fee

- 1 % network conversion (Mastercard rate) + issuing bank fee (around 2 %) = ~3 % total

- Avoid dynamic currency conversion (DCC), which adds higher markups

Late Payment Fee

- Up to ~€35 (or equivalent) if you miss your payment due date

Tip:

- Always aim to pay the full statement balance by the due date to avoid high interest (TAE).

- Avoid cash advances and FX transactions to sidestep fees.

- Decline DCC offers to ensure you’re charged at the best exchange rate.

Eligibility Criteria

To apply, you must meet specific basic requirements.

These ensure you’re legally eligible, financially supported and capable of managing the credit responsibly.

- Age Requirement: You must be at least 18 years old.

- Residency in Spain: You need to be a legal resident of Spain.

- Stable, Verifiable Income: You must provide regular income documentation, such as payslips, pension statements, or similar records.

- Clean Credit Record: You should not appear on default or debt blacklist databases.

- Spanish Bank Account: You’ll need an active local bank account for billing and payments.

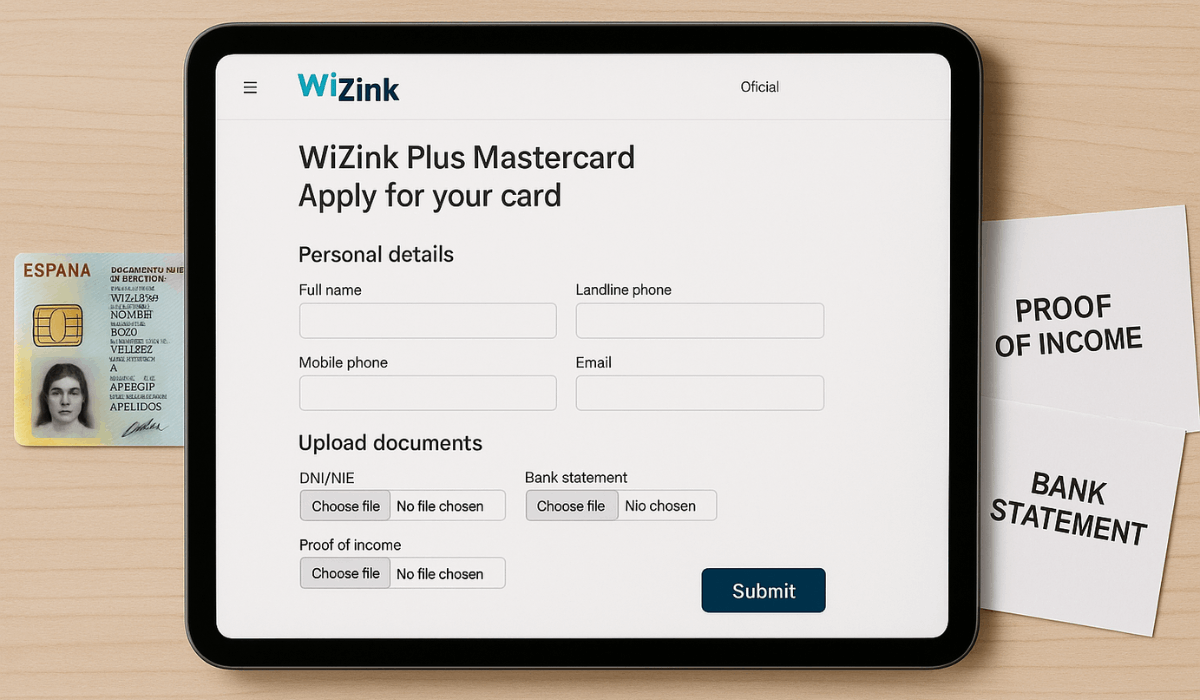

Documents to Prepare

You’ll need several key documents to verify your identity, residence, and financial stability when applying for this card.

Having them ready speeds up the approval process.

- Identification (DNI/NIE or Passport): A current, valid national ID or passport is required for identification purposes.

- Proof of Income: Submit your latest payslips, pension statements, or employment contract showing permanent employment and sufficient earnings (e.g., ≥ €1,000/month).

- Bank Statement (IBAN): Provide a recent Spanish bank statement showing your account details for billing.

- Employment Contract (Optional): In some cases, a copy of your work contract is required to confirm the employment type and income stability.

- Contact Details: Provide a valid mobile number and email for identity checks and application updates.

Application Steps

Applying for the WiZink Plus Mastercard is a fast and entirely online process.

You’ll complete a form, upload your documents, and await approval—all from the comfort of your own home.

Here’s a step-by-step guide to help you through the process.

- Visit the official WiZink website: Go to WiZink’s site and select the Plus Mastercard under credit card options.

- Complete the online form: Enter your details (name, age, address), financial info (income, employment), and residency status.

- Upload required documents: Attach a valid ID (DNI/NIE or passport), recent bank statement, and proof of income.

- Review and agree to terms: Check interest rate, fees, and repayment options. Accept the terms and conditions.

- Submit application: Click “Submit” to send your request. You’ll receive an immediate preliminary response.

- Await final approval: The formal decision typically arrives within 24 to 72 hours via email or app notification.

- Receive and activate your card: If approved, your card will arrive in 5–7 business days. Activate it using the instructions provided.

Post-Application Process

Once you’ve submitted your application, there are just a few steps left before it’s in your hands and ready to use.

Here’s what happens next:

- Immediate response: You may get a preliminary approval or denial right after submitting your application.

- Final decision (24–72 hours): WiZink typically completes the full review and sends a confirmation email or app notification within 1–3 days.

- Card dispatch (5–10 business days): Once approved, the physical card is mailed. Most issuers, including WiZink, deliver within about a week.

- Card activation: After delivery, activate the card by following the instructions included with it—typically via the app, phone, or website.

- Start using: You’re ready to use your card online or in-store once activated.

Tip:

- If you need the card urgently, you can sometimes request expedited shipping—try contacting WiZink’s support right after approval.

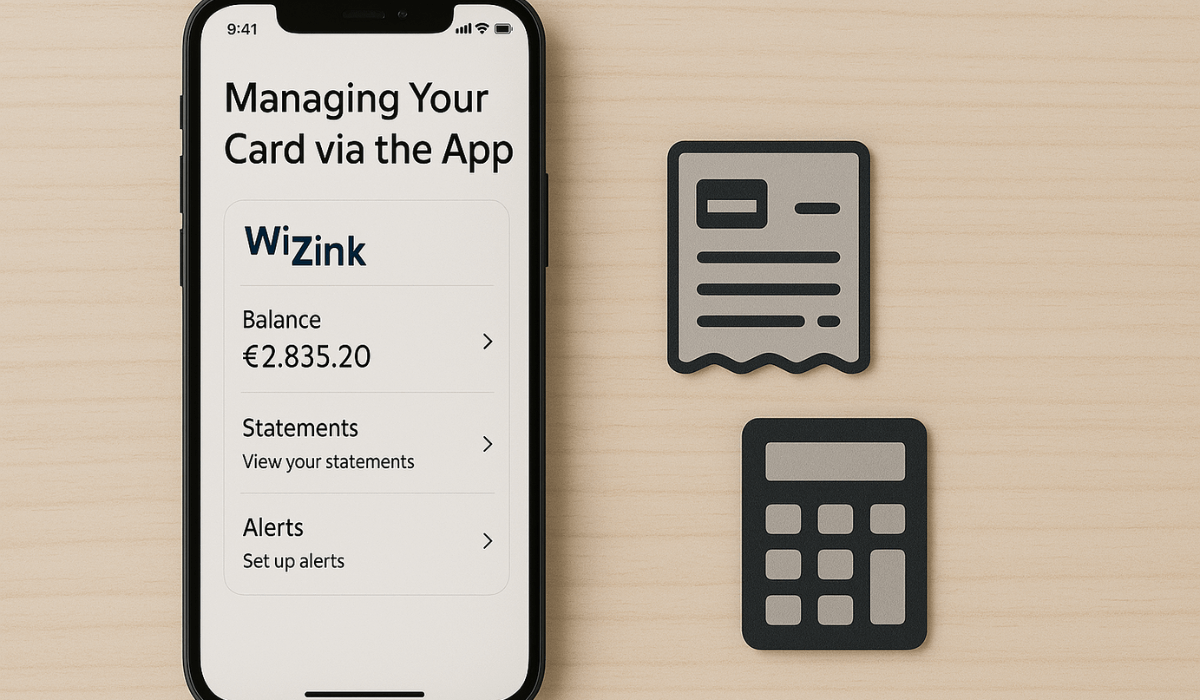

Managing Your Card

Once your card is active, managing it is simple using their digital tools.

You can control payments, monitor transactions, and customize your card usage.

- Track transactions in real-time: Use the WiZink mobile app to check your balances, view recent purchases, and monitor your available credit.

- Set up payment alerts: Enable SMS or push notifications to remind you of due dates and spending limits.

- Choose your payment method: Select between full balance payment, fixed monthly amounts, or a percentage of your total balance.

- Convert purchases into installments: Use features like “Plan Aplaza” or “Crédito Ahora” to split payments over several months for more flexibility.

- Temporarily block or unblock your card: Lost your card? Instantly freeze it via the app and reactivate it once you’ve found it.

- Update contact and billing info: Modify your phone number, email, or linked bank account anytime through your online account or the app.

Contact Information

Here are the main contact options for the WiZink Plus Mastercard—from phone lines to email and in-app messaging.

General Card Support:

- 91 787 47 47 (Mon–Fri: 9 h–19 h; Sat: 9 h–15 h)

Card Lost or Stolen (24/7):

- 91 362 62 00 — Call anytime to block your card immediately

Consumer Affairs:

- 900 81 48 90 (Mon–Fri: 9 h–19 h; Sat: 9 h–15 h)

Email Contacts

- Complaints & official claims: [email protected]

- Insurance/travel purchase inquiries: [email protected]

In‑App or Online Message Inbox:

- Access “Buzón” via the WiZink app or online platform to send secure messages

To Sum Up

The WiZink Plus Mastercard offers a smart mix of rewards, flexibility, and zero annual fees.

With a simple online application and strong mobile tools, it’s built for convenience and control.

Apply today and take advantage of cashback, easy payments, and full digital access to your card.

Disclaimer

Terms, interest rates, and eligibility criteria for the WiZink Plus Mastercard are subject to change and may vary based on your financial profile.

Always review the official WiZink website or contact their customer service for the most accurate and up-to-date information.