Securing extra cash for a project or debt consolidation is simpler when the lender offers predictable costs, fixed terms, and clear eligibility rules.

HSBC delivers that combination through a fully digital application available worldwide, with specific terms that currently apply to UK residents.

What an HSBC Personal Loan Offers

HSBC provides unsecured loans that deliver a lump sum between £1,000 and £25,000, repaid in fixed monthly installments.

Borrowing up to £15,000 qualifies for terms of 12–60 months, while larger amounts can be stretched to 96 months, giving you the space to spread out significant costs without straining your monthly cash flow.

Typical uses include home upgrades, car purchases, medical bills, or combining multiple debts into one manageable payment. Using the bank’s real-time calculator upfront lets you preview payments and compare options in seconds.

Eligibility Check: Meet the Basics First

Confirm qualification early to avoid wasting time on an application that cannot be approved.

You must satisfy every point below:

- Be at least 18 years old and permanently reside in the UK, allowing HSBC to verify your identity through national records.

- Show annual taxable income or pension of £10,000 or more before tax, proving enough capacity to handle repayments.

- Hold a UK bank or building society account with Direct Debit access because all instalments are collected automatically.

- Avoid Basic Bank Accounts, which do not support credit products under current HSBC rules.

- Apply jointly only via telephone, as the online system is currently only compatible with single applicants.

Meeting these criteria does not guarantee approval; however, falling short on any single point will result in immediate rejection.

Interest, Fees, and the True Cost

For loans of £7,500–£20,000, HSBC advertises a representative APR of 6.4%. The actual rate you receive depends on your credit history, income stability, and the requested term, and it may be as high as 22.9% APR.

A sample borrowing of £10,000 over 60 months results in approximately £194.35 per month and a total repayment of nearly £11,661.05.

Because the bank imposes no setup fees and allows unlimited free overpayments, every extra pound you pay early cuts the overall interest charge.

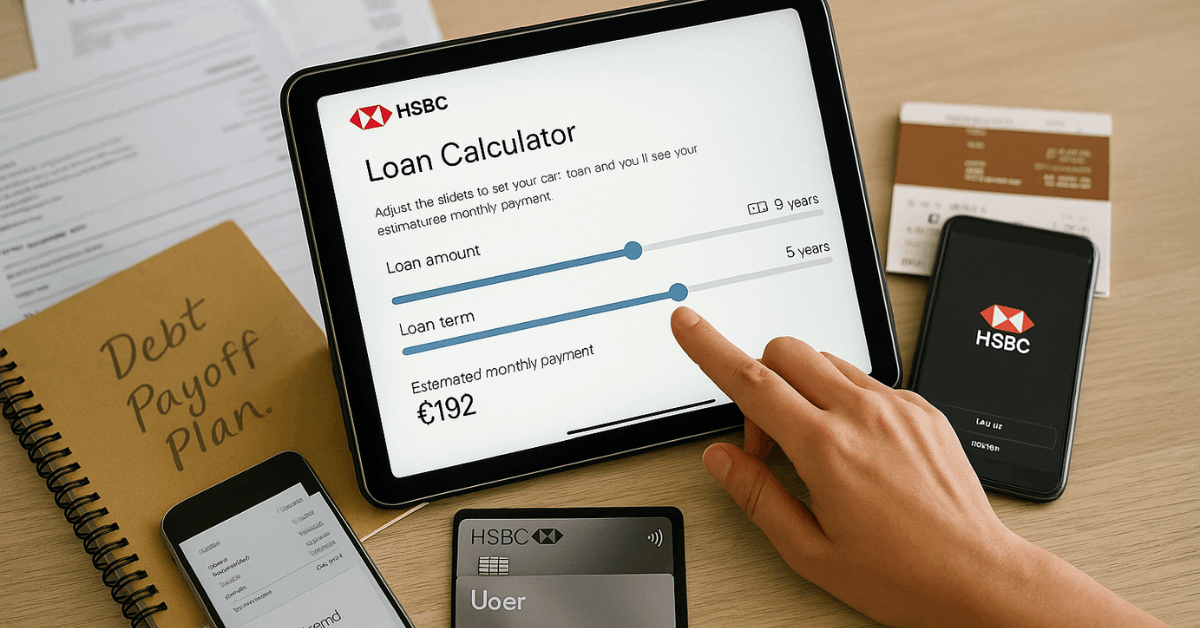

Using the Loan Calculator for Smart Planning

Open the calculator, enter a target amount, and adjust the term slider until the monthly figure fits comfortably within your budget.

Extending the term lowers each installment yet raises total interest, while shortening the term does the opposite.

Because the tool updates instantly, you can test multiple combinations until the repayment schedule aligns with financial goals.

Permitted and Restricted Uses

Avoid compliance issues by matching your intended purpose to HSBC’s lending policy.

Allowed purposes commonly include:

- Consolidating existing unsecured debts to simplify budgeting.

- Funding home improvements, vehicle purchases, education costs, or emergency expenses.

- Covering personal milestones such as weddings or large household purchases.

Prohibited purposes are strictly enforced:

- Buying any property or land, including deposits, shared-equity stakes, or holiday accommodation.

- Gifting funds for someone else’s property costs, such as legal fees or stamp duty.

- Financing gambling, share dealing, or cryptocurrency transactions in any form.

- Paying business expenses, capital investments, or startup costs, regardless of scale.

If your plan touches any restricted area, consider alternative funding sources before applying.

Key Benefits That Set HSBC Apart

Leverage these built-in advantages to keep borrowing affordable and straightforward.

- No arrangement charge, so every pound borrowed goes toward your actual need, rather than an upfront fee.

- Fixed repayments that never fluctuate, making long-term budgeting easier.

- Free overpayments at any time, letting you shorten the term and cut interest without penalties.

- Same-day funding for existing current-account customers, delivering speed when timing matters.

- The entire journey is handled online worldwide, from eligibility checks to electronic agreement signatures.

Step-by-Step Online Application

Follow these actions to complete the process quickly and accurately.

- Visit HSBC’s loan page and start the calculator to test the amount and term combinations.

- Sign in to online banking if you are already a customer; new applicants will create secure credentials during the registration process.

- Complete the loan details section, specifying the amount, desired term, and reason for borrowing.

- Enter personal information, including address history, employment, and income figures, ensuring every number matches supporting documents.

- Review the automated summary for accuracy, then consent to a credit check.

- Submit the application and wait for an instant or near-instant decision; complex profiles may take up to five working days.

- Accept the digital agreement once approved. Existing customers typically see their funds arrive the same business day, while external accounts receive the money within three working days.

Managing the Loan After Approval

Stay in control once repayments begin and react proactively when circumstances change.

Early Settlement

Request a settlement figure through online banking or phone support when planning to clear the balance. HSBC adds up to 28 days’ interest plus one extra month in some cases, yet closing early still saves money for most borrowers.

Topping Up or Taking a Second Loan

Qualified customers can either increase the existing balance (top-up) or apply for an additional standalone loan. Both options trigger a new credit assessment, so please check your affordability using the calculator before proceeding.

Staying on Track

Missed or delayed payments generate extra interest and may damage credit history worldwide. Setting calendar reminders and maintaining a buffer in the funding account helps avoid accidental slips.

Support Channels for Questions or Assistance

Quick access to help ensures minor issues never become major problems.

| Purpose | Telephone (UK) | Telephone (International) | Availability |

| General lending queries | 0800 023 1441 | +44 207 367 7881 | Mon–Fri 08:00–18:00 |

| Existing loan servicing | 03457 404 404 | +44 1226 261 010 | Daily 08:00–20:00 |

| Premier customers | 03457 707 070 | +44 1226 260 260 | 24/7 |

You can also chat inside the HSBC Mobile Banking app or visit a branch for face-to-face guidance.

Is This the Right Loan for You?

An HSBC Personal Loan suits borrowers seeking predictable payments, zero setup fees, and a fast digital approval process.

If your goal falls within the permitted uses and you meet eligibility criteria, the product provides straightforward access to funds up to £25,000.

However, always compare alternative rates worldwide, factor in total interest across varying terms, and confirm that repayments fit comfortably alongside existing obligations.

Disclaimers

Loan approval remains subject to status, affordability checks, and HSBC policy, which can change without notice.

Quoted 6.4 % APR applies only to representative cases between £7,500 and £20,000; actual rates may reach 22.9 % APR depending on credit profile.

For the latest terms, calculators, and eligibility updates, visit the official HSBC website or contact customer support directly.